Bitcoin 'diamond hands' cut selling by nearly 50% at $73.8K — Research

Bitcoin (BTC) “diamond hands” are not acting like BTC price action peaked at its $73,800 all-time highs.

In new research on May 28, on-chain analytics firm Glassnode showed that selling pressure from older coins is barely half as intense as prior bull market tops.

Bitcoin investors hold off on profit-taking

Bitcoin long-term holders (LTHs) continue to resist the urge to take profit — even with BTC price action near $70,000.

Despite being in profit by an average of 3.5 times, LTH wallets are so far not selling BTC at a rate that would make the current bull market unsustainable.

“As prices appreciate in response to renewed buy-side pressure, the importance of the opposing side, the sell-side pressure, from Long-Term Holders grows in tandem,” Glassnode explained in the latest edition of its weekly newsletter, “The Week On-Chain.”

“Therefore, we can evaluate the unrealized profit of the LTH cohort as a measure of their incentive to sell, and their realized profit to assess actual sell-side.”

LTHs refer to wallets holding inbound BTC for 155 days or more, and reflect what should be the less speculative end of the Bitcoin investor spectrum.

Using the market value to realized value (MVRV) metric, Glassnode showed that soon, LTHs en masse will enter historically high levels of unrealized profit.

“Historically, the transition phase between a bear and a bull market sees LTH trade above 1.5, but below 3.5, and can last for one to two years,” it continued.

“If the market uptrend remains sustainable, forming new ATHs in the process, the unrealized profit held by LTHs will expand. This will substantially elevate their incentive to sell, and eventually leads to a degree of sell-side pressure that gradually exhausts the demand side.”

LTH sell pressure "has noticeably contracted"

Taking March’s latest all-time high into account, however, provides room for optimism should BTC price discovery return.

Related: Bitcoin has '3 bullish reasons' to head higher after $68K dip — analysis

Even at the $73,800 peak, LTHs were not distributing to the market as heavily as during prior bull market blow-off tops.

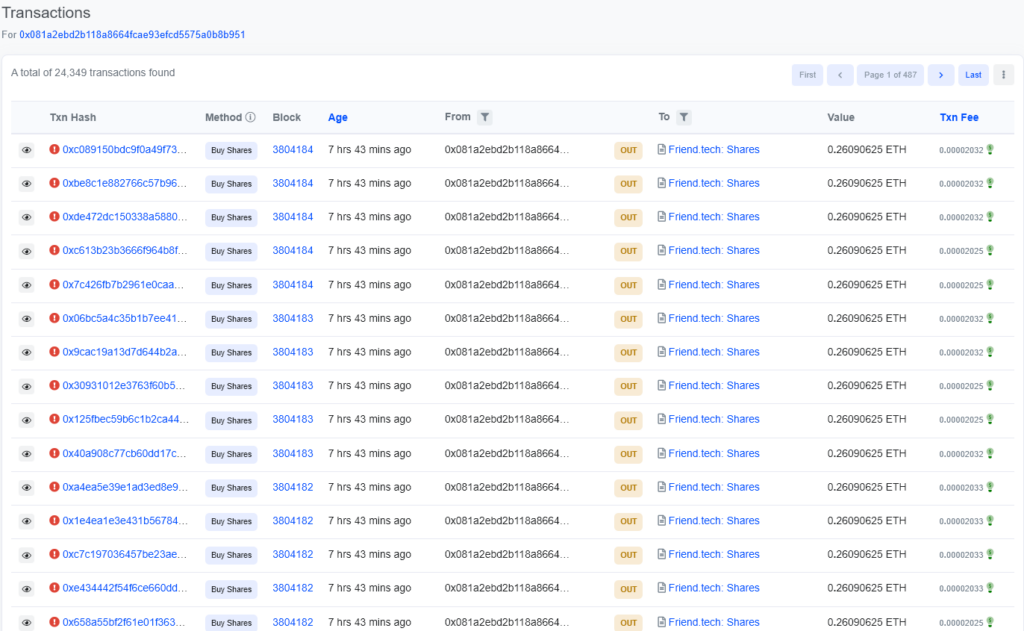

“During the last two bull markets, the LTH net distribution rate reached a substantial 836k to 971k BTC/month,” the newsletter stated.

“At present, the net sell pressure peaked at 519k BTC/month in late March, with approximately 20% of this originating from Grayscale ETF holders.”

Glassnode referred to ongoing selling by investors in the Grayscale Bitcoin Trust (GBTC) — an institutional investment vehicle which this week lost its poll position among spot Bitcoin ETFs by assets under management.

Going forward, the report sees LTHs continuing what has been a resurgent investment trend since the end of last year.

“In the wake of significant long-term holder investor distribution into the $73k ATH, sell-side pressure has noticeably contracted,” it wrote in part of its conclusion.

“The Long-Term Holders have since started to re-accumulate coins for the first time since December 2023.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.