Ethereum transaction fees hit record low as Layer-2 networks siphon activity

According to Ultrasound.money data, the average gas has dropped to 4.81 Gwei — the lowest level since the network completed the Merge event in 2022.

Market observers attributed this decline to increasing activity on L2 networks following the completion of the Dencun upgrade. The Dencun upgrade significantly reduced fees for L2 networks, making transacting on the base layer less attractive.

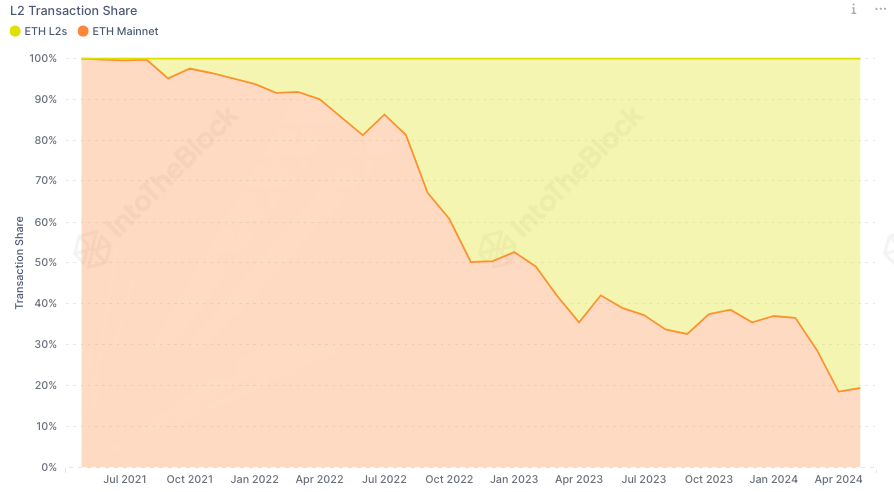

Notably, the blockchain analytical platform IntoTheBlock reported:

“An increasing number of transactions are now being settled on Ethereum Layer 2s. Last month, the three largest L2s hit a record 82% transaction share of all Ethereum transactions.”

Furthermore, the number of transactions on Arbitrum has seen strong growth, reaching over 2 million daily transactions on May 8 — a significant rise from the early March average of 1 million.

L2beats data further indicates that Base and Arbitrum averaged 30 and 20 transactions per second, respectively, while Ethereum managed 13 transactions per second during the same period.

ETH turns inflationary

Meanwhile, CryptoQuant analysis revealed that ETH has transitioned to an inflationary state post the Dencun upgrade, resulting in diminished gas fees and reducing its burn rate.

In light of this development, the firm noted:

“Since The Merge, Ethereum appeared to be on track with its ‘ultra-sound’ money narrative, showing a slight reduction in the total ETH supply. However, the post-Dencun upgrade challenges this by reducing transaction fees and the ETH burn rate, leading to an increase in supply.”

CryptoQuant further elaborated that the Dencun upgrade environment has presented a scenario where maintaining deflation would require a substantial increase in network activity, contrasting the current trend of low gas fees and reduced burn rates.

Notably, UltraSound.Money data shows that the daily amount of ETH burned during the past day was 519 ETH, a record low for the network.