Is the altcoin market set for an ‘explosive rally?’ Analysts eye these 3 indicators

The altcoin market is currently at the "disbelief stage," which, if history repeats, could soon move on to an "explosive rally," according to crypto traders closely watching three techindicators for confirmation.

“Altcoins market cap is currently at the disbelief stage, historically followed by an explosive rally,” crypto analyst Milkybull crypto told their 66,600 X followers in a May 11 post.

The disbelief stage is when investors remain skeptical despite positive market indications, as reflected by a significant drop of 24 index points on the Fear and Greed Index over the past 30 days. The "Greed" score is currently 56.

This comes alongside the total altcoin market cap — which excludes the top 10 cryptocurrencies — declining 17.55% over the past 30-days to $264.9 billion, as per TradingView data.

Although, it is still holding above the $250 billion support level, and is "positioning itself for a future move to the upside," pseudonymous crypto trader Rekt Capital told their 465,300 X followers in a May 12 post.

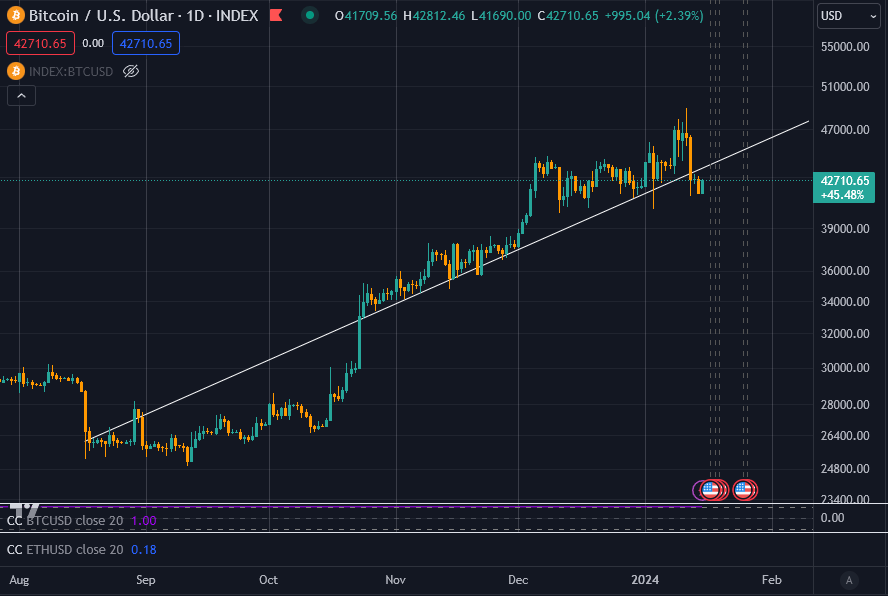

Traders are keeping an eye on three indicators across the broader crypto market — the exponential moving average (EMA) over 20 days, the Stochastic RSI, and Bitcoin dominance — to support their predictions about the direction of the altcoin market.

The EMA is the average price across the period, with greater weight on more recent periods. If the total crypto market cap “retests” the EMA20 while also “crossing bullish” on the Stochastic RSI — which measures the relative strength and weakness of the RSI indicator itself — it could lead to “rally time,” pseudonymous crypto trader Titan of Crypto stated in a May 11 post.

Related: Altcoins will bottom in early summer before bull run — Analyst

The Bitcoin dominance chart — measuring Bitcoin's market share relative to the overall crypto market — stands as one of the oldest yet most referenced indicators. It can provides traders with the overall investor sentiment and risk appetite in the market.

At the time of publication, Bitcoin’s dominance is 54.7%, down 0.56% over the past week. A further "fall from here can start an altseason,” pseudonymous technical analyst Yoddha claimed in a May 11 post on X.

Magazine: Buy altcoins now, but sell before ‘mid-2025’: Charles Edwards, X Hall of Flame

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.