Memecoin trader loses over $1M following Normie exploit

An unfortunate trader lost over $1 million worth of digital assets following the Normie memecoin exploit.

The memecoin trader spent over $1.16 million to buy 11.23 million Normie (NORMIE) memecoins, but his initial investment fell over 99% to just $150, according to a May 26 X post by Lookonchain:

“He spent $1.16M to buy 11.23M $NORMIE at $0.1035 from Mar 25 to Apr 9 and has held it until now without selling it.”

Normie is a Base-native memecoin that suffered a smart contract exploit that wiped over $41.7 million from the token's market capitalization in just three hours. Lookonchain was the first to flag the exploit in a May 26 X post.

Normie’s value fell over 96% following the exploit, as its market cap bottomed out around the $200,000 mark before starting a small recovery, according to CoinGecko data.

Earlier on May 27, the Normie team reportedly agreed to the hacker's offer to return 90% of the stolen NORMIE tokens. This agreement was contingent on Normie using the returned funds, along with $2.3 million from the team's development wallet, to launch a new token to reimburse NORMIE holders.

The hacker has demanded that the token launch must occur before they return the stolen funds, as stated in a blockchain message from the exploiter seen by Lookonchain.

“The dev wallet made significantly more than I did during this exploit, and I have no other way to ensure that those funds are used appropriately.”

After the hacker's offer, X was inundated with a wave of fake Normie posts, falsely claiming to announce the relaunch of the new token. These posts aimed to lure people into clicking on fraudulent links.

Over 72,000 Normie holders were impacted by the smart contract exploit, that was first detected in March, according to a May 26 X post by on-chain analytics firm Quick Intel.

Related: Ether price could hit $4.5K before ETH ETF: DeFiance Capital founder

Memecoin season continues, sending Pepe to new all-time high

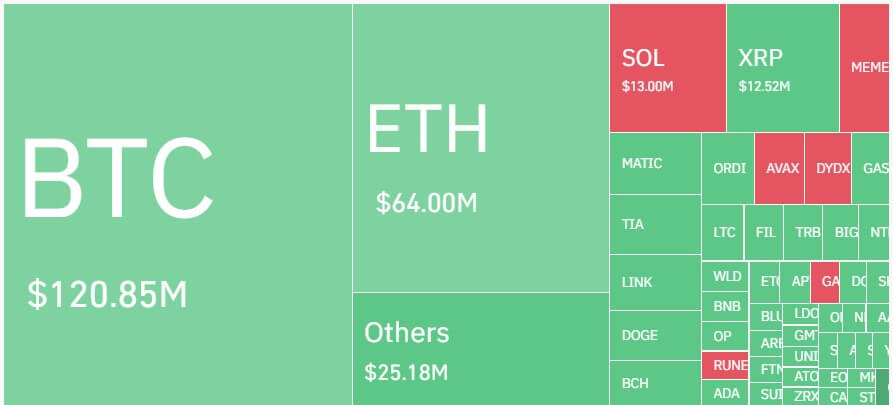

Despite the unfortunate incident, memecoin traders remain unfazed as they continue buying animal-themed cryptocurrencies.

Frog-themed memecoin Pepe (PEPE) reached a new all-time high of $0.00001718 on May 27, after rising over 75% during the past week, CoinMarketCap data shows.

Since memecoins lack intrinsic utility, they are among the most volatile digital assets. Despite the inherent risks, some traders are making millions by successfully navigating this high-risk market segment.

Two weeks ago, a savvy Pepe trader turned $3,000 into $46 million by trading the memecoin. The return of the GameStop saga bolstered the Pepe price, and the trader made an over 15,718 times return on initial investment.

Magazine: Trader turns $3K into $46M in PEPE, Ethereum gas overhaul, Tornado dev guilty: Hodler’s Digest, May 12-18