PayPal banks on Solana's stablecoin dominance to bolster PYUSD adoption

Solana corroborated this development in a separate statement, adding that PYUSD holders would enjoy a “high throughput and speed of settlement” and a new token extension feature that expands functionality for compliance.

Jose Fernandez da Ponte, PayPal’s Senior Vice President, said:

“Making PYUSD available on the Solana blockchain furthers our goal of enabling a digital currency with a stable value designed for commerce and payments.”

Experts suggested that the move would aid PYUSD adoption among retail crypto users. Phantom, the most popular Solana-focused crypto wallet service provider, said its users can now buy and transfer PYUSD from their wallets without transaction fees.

Meanwhile, this expansion comes nearly a year after PYUSD’s debut on Ethereum in August 2023. Since then, the stablecoin has recorded modest growth and attracted regulatory attention from the US Securities and Exchange Commission (SEC).

According to CryptoSlate’s data, PYUSD’s market capitalization stood at approximately $400 million as of press time.

Stablecoin powerhouse

Since the beginning of the year, the Solana blockchain has quietly emerged as a dominant stablecoin network thanks to its high transaction speeds and extremely low costs.

PayPal identified this as one of the reasons for its expansion into the blockchain. The company noted that Solana has become the leading platform for tokenized transactions and is ideal for PYUSD as it gains traction in payment use cases among its over 30 million merchants.

Data from blockchain analytics platforms Artemis and Visa confirms that Solana was the most used blockchain for stablecoin transfers in the past month. The stablecoin supply on this layer-1 network has surged to over $4 billion, with Circle’s USD Coin (USDC) making up more than 70% of these assets.

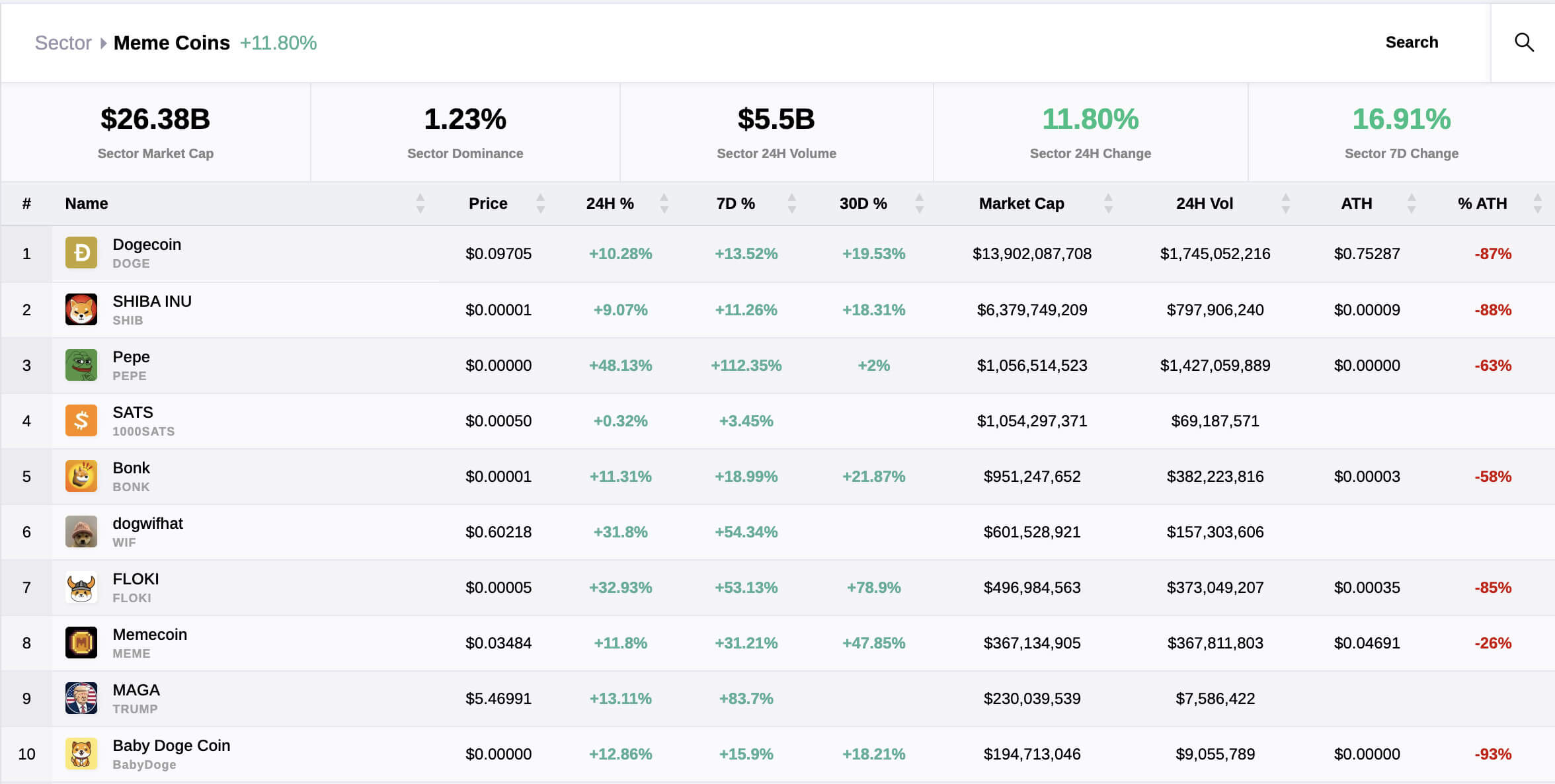

Market observers attribute this growth to the significant influx of capital into the network, driven by the memecoin frenzy and the expanding DeFi activity within the Solana ecosystem.