US Bitcoin ETFs see record outflows as Hong Kong counterparts thrive

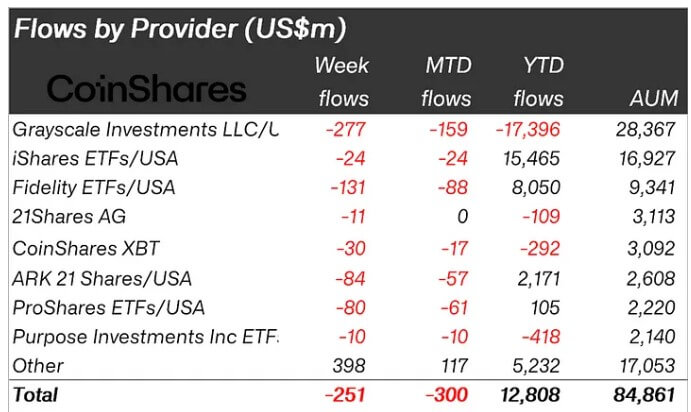

According to the report, the market saw an outflow totaling $251 million, with the Newborn Nine spot Bitcoin ETFs accounting for over 60%, or $156 million, of these flows.

James Butterfill, CoinShares head of research, said:

“We estimate the average purchase price of these ETFs since launch to be $62,200 per bitcoin, as the price fell 10% below that level, it may have triggered automatic sell orders.”

A breakdown of the flows showed that Fidelity’s FBTC saw the highest outflow amount, with $131 million exiting the fund, followed by Ark 21 Shares’ ARKB, which saw outflows amounting to $84 million.

Meanwhile, BlackRock’s IBIT saw a modest negative flow of $24 million, while Grayscale’s Bitcoin ETF continued its outflow trend, with $277 million withdrawn during the period.

The performance of these ETFs pushed outflows from the United States to $504 million. Notably, Canada, Switzerland, and Germany also saw outflows totaling $9.6 million, $9.8 million, and $7.3 million, respectively.

However, despite the performance of US-based spot Bitcoin ETFs, the newly launched spot-based Bitcoin and Ethereum ETFs in Hong Kong saw $307 million in inflows during the first week of their trading.

Ethereum and Polkadot draw inflows

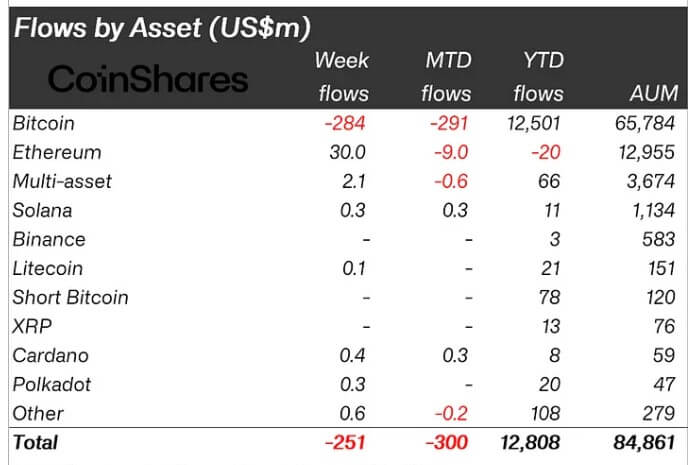

Across assets, Bitcoin saw outflows totaling $284 million, propelling its month-to-date outflow to $291 million.

CryptoSlate’s previous reports found that crypto investors increasingly sought exposure to altcoins while reducing their exposure to flagship digital currencies like Bitcoin.

This trend continued this week as altcoins like Avalanche, Cardano, and Polkadot saw modest inflows of approximately $0.5 million, $0.4 million, and $0.3 million, respectively.

Notably, Ethereum broke its 7-week spell of negative flows, seeing $30 million of inflows last week. This has reduced ETH’s year-to-date outflow to a negative of $20 million.