Binance CEO welcomes Standard Chartered move to launch Bitcoin trading desk

This move would make the bank one of the first major traditional financial institutions to offer direct trading services for the top digital assets and could provide competition for Binance’s dominance of the sector.

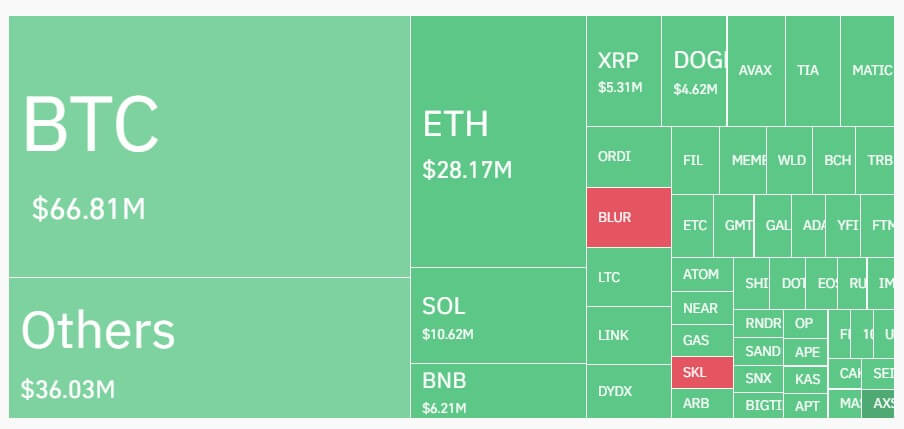

Binance is the largest crypto exchange by trading volume and has faced several regulatory challenges over the past years. According to Kaiko data, over 53% of BTC’s overall trading volume on centralized exchanges occurs on the platform.

Pro-crypto moves

Sources familiar with the matter told Bloomberg that the new desk will be part of the bank’s foreign exchange trading unit and operate out of London. A spokesperson for the bank reportedly said:

“We have been working closely with our regulators to support demand from our institutional clients to trade Bitcoin and Ethereum, in line with our strategy to support clients across the wider digital asset ecosystem, from access and custody to tokenization and interoperability.”

The bank has yet to respond to CryptoSlate’s request for additional commentary at press time.

Standard Chartered’s initiative reflects the growing demand for institutional crypto adoption and highlights the bank’s commitment to the emerging industry. Currently, the bank has stakes in two crypto businesses, Zodia Custody and Zodiac Markets, which provide services such as crypto custody and over-the-counter trading of digital assets.

Institutional interest

The crypto community has embraced the news of the bank’s move, viewing it as a significant step towards the continued institutional adoption of crypto.

Market experts explained that the move was unsurprising as traditional financial institutions like banks need to adapt to the current economic landscape, considering the approval of several crypto-related ETFs in major markets like the US and Hong Kong.

Nonetheless, banks would be required to navigate a stringent regulatory environment regarding their exposure to digital assets.

The Basel Committee on Banking Supervision advises banks to assign a 1,250% risk weight to unhedged crypto exposures. In the US, regulations such as the controversial SEC’s Special Accounting Bulletin (SAB) 121 impose additional constraints on banks dealing with digital assets.