Bitcoin ETF outflows hit $200 million ahead of FOMC meeting

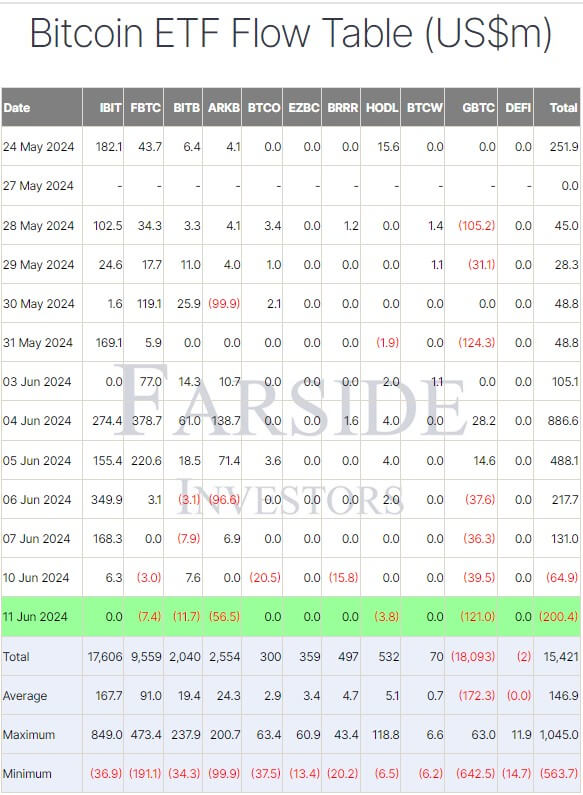

Data from Farside shows that on June 11, Bitcoin ETFs had cumulative outflows of $200 million, with withdrawals driven by five issuers.

ETF outflows

Grayscale’s GBTC led the outflows with $121 million, raising its total outflows to $18.03 billion. Ark Invest’s ARKB followed with nearly $57 million in net outflows. Bitwise’s BITB reported approximately $12 million in outflows, while Fidelity and VanEck saw smaller net outflows of $7.4 million and $3.8 million, respectively.

Despite these significant outflows, the funds have accumulated a total net inflow of $15.42 billion since their launch in January.

These substantial outflows contributed to Bitcoin’s price drop to as low as $66,207 in the past 24 hours. Crypto analyst Patrick Scott commented:

“Bitcoin ETFs are adding a new reflexive element to price, where off-hours dumps translate to outflows on the next trading day.”

Bitcoin has since recovered to $67,449 as of press time.

FOMC ahead

Market experts believe that BTC’s recent price performance and the ETF outflows indicate investors’ caution ahead of the crucial Federal Open Market Committee (FOMC) meeting.

Notably, three US lawmakers—Senators Elizabeth Warren, Jacky Rosen, and John Hickenlooper—have urged the Federal Reserve to lower the federal funds rate from its two-decade high of 5.5%. They argued:

“This sustained period of high interest rates is already slowing the economy and is failing to address the remaining key drivers of inflation.”

Despite this, the market expects no change in interest rates. According to the CME FedWatch Tool, 99.4% of investors predict the rate will stay at the current level of 525-550 bps.