Bitcoin ETFs notch nearly $500M inflows despite nobody searching for it

United States spot Bitcoin (BTC) exchange-traded funds (ETFs) saw collective inflows of $488.1 million on June 5, but Google data shows hardly anyone is searching for it compared to 2021’s bull run — a bullish sign that retail hasn't arrived yet.

The ETFs recorded their second-best inflow day of $886.6 million on June 4. The next day achieved around half that number, with Fidelity Wise Origin Bitcoin Fund (FBTC) making up the largest share of inflows at $220.6 million, Farside Investors data shows.

BlackRock’s iShares Bitcoin Trust (IBIT) was second with $155.4 million, and even the Grayscale Bitcoin Trust (GBTC) — which has seen net outflows exceed $17.8 billion since January — saw a $14.6 million net inflow.

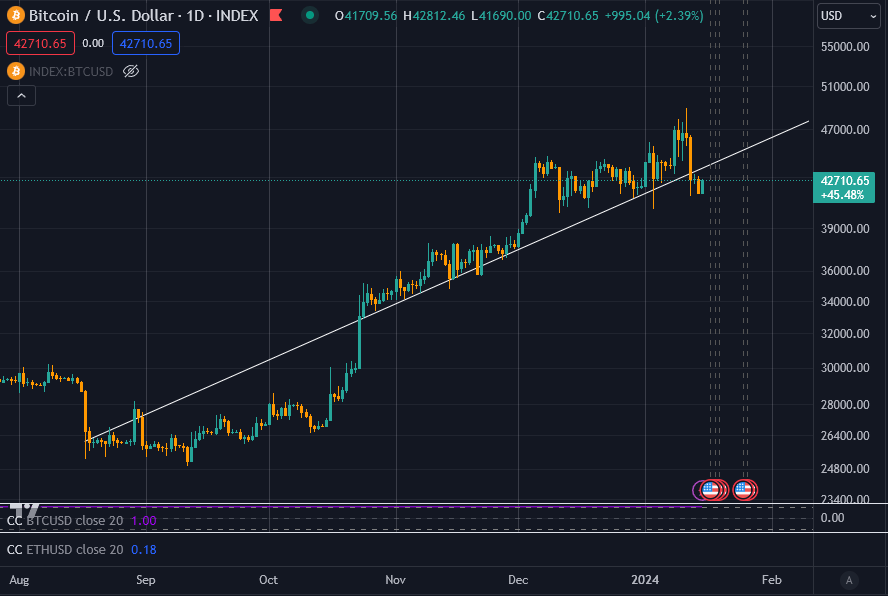

Despite the strong inflows and a Bitcoin rally past $71,000, Google Trends data shows that, compared to 2021, hardly any Americans are conducting searches related to Bitcoin, Bitcoin ETFs, its price, or crypto in general.

Google Trends data, which gives a value out of a total of 100 based on a search interest’s relative peak popularity — gave a score of 31 for searches for “Bitcoin” originating from the U.S. on June 5, while “Bitcoin ETF” had a score of 1.

Other searches, like “Bitcoin price” and “crypto” have received a higher index score of 18 and 13, respectively, but are still far below the scores during 2021’s retail-driven bull run.

Crypto-related search interest has waned over the year, with interest spiking across the board on Jan. 11 — the day the U.S. approved ten spot Bitcoin ETFs — and on March 5 when Bitcoin broke above $69,000 for the first time since 2021.

Related: Bitcoin ETFs make 26% of BlackRock's 2024 inflows, 56% of Fidelity’s

Search interest for “Bitcoin” hit its peak in May 2021. A few weeks earlier, it had surpassed $50,000 for the first time and would later go on to hit its long-standing all-time high of nearly $69,000 in November 2021.

Crypto analyst Miles Deutscher, in a June 6 X post, also shared data showing viewership of crypto-related YouTube channels was down significantly from 2021, despite Bitcoin having already surpassed the peak price then.

In 2021 when Bitcoin hit its then-peak, crypto YouTube viewership was around 4 million daily views, which has dropped to around 800,000 views a day in 2024 despite BTC reaching new highs.

“Retail isn’t back yet,” Deutscher claimed. ”There is no indicator in the world that sums up the current state of the market better than crypto [YoutTube] views.”

Magazine: Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and governments — Trezor CEO