Bitcoin ETFs show 'staying power,' now landing in Thailand

After the US Securities and Exchange Commission (SEC) approved these products in January, they have seen substantial inflows after a recent dip in volumes.

Bitcoin ETF lands in Thailand

Thailand’s Securities and Exchange Commission (SEC) has reportedly approved ONE Bitcoin ETF Fund by One Asset Management (ONEAM), marking the country’s first Bitcoin ETF.

The ETF is part of ONEAM’s Unhedged fund, typically unavailable to retail investors. The fund would invest in 11 top global funds based in Hong Kong and the US to boost liquidity and safety. Additionally, it would ensure that its coin storage policy aligns with international standards.

ONEAM CEO Pote Harinasuta praised the approval, calling the product a good alternative to other financial assets. He noted that it allows investors to diversify their assets and manage investment risks.

Meanwhile, this approval marks Thailand’s entry as the second Asian country to endorse a spot Bitcoin ETF. In April, Hong Kong authorities approved several Bitcoin and Ethereum ETFs. Although these products have struggled with volume, other Asian regulators remain interested in launching similar products for their citizens.

‘Staying power’

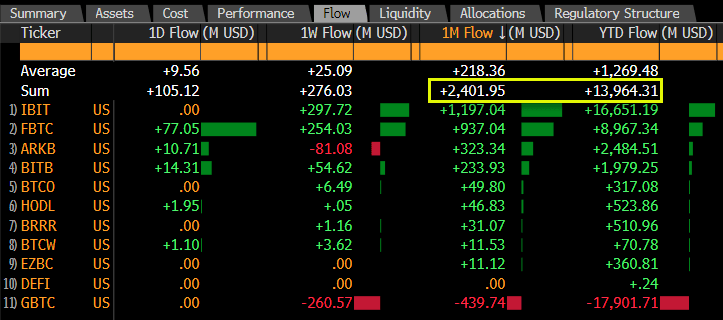

Bloomberg senior ETF analyst Eric Balchunas, citing data from Bloomberg Intelligence, reported that US-based spot Bitcoin ETFs recorded 15 consecutive days of net inflows.

These ETFs attracted $2.4 billion in inflows over the past month, trailing only the SPDR S&P 500 ETF Trust and Vanguard S&P 500 ETF. This brings the year-to-date total for Bitcoin ETFs to approximately $14 billion.

Despite occasional days of zero flows and outflows recently, Balchunas noted that the current streak demonstrates the “staying power” of Bitcoin ETFs. Notably, the 15-day streak marks the second-longest positive run since the ETFs started trading in January when they saw 17 consecutive inflows.