Bitcoin battles key resistance as trader flags $100K BTC price 'magnet'

Bitcoin (BTC) passed $70,000 at the June 3 Wall Street open as upside after the prior daily close continued.

BTC price: Key resistance hurdle remains $69,000

Data from Cointelegraph Markets Pro and TradingView showed the day’s BTC price upside nearing 4%.

Bulls began the week with a fresh bid to flip $69,000 — the site of Bitcoin’s old 2021 all-time high and a key psychological level — back to firm support.

Analyzing the current landscape on exchange order books, popular trader Skew noted a price premium in place on perpetual swaps.

“Spot market still in control here, pay close attention around $70K,” he wrote in part of a post on X (formerly Twitter).

“Would like to see continued decline in perp premium towards more of a spot premium.”

The latest data from monitoring resource CoinGlass showed BTC/USD eating into overhead liquidity above $70,000, with little nearby resistance remaining at the time of writing.

“The $66K & $72K levels remain important from a liquidity perspective. Eyes on those levels,” fellow trader and commentator Daan Crypto Trades responded to the data.

Bitcoin’s relatively brisk gains meanwhile sparked fresh calls for a return to price discovery.

Nearly three months after hitting its latest all-time highs, BTC/USD now has a target of $100,000, trader Kaleo insists.

“It's time for round 2,” he told X followers on the day alongside a chart showing the run to the highs and subsequent consolidation phase.

“$100K is a magnet.”

Ethereum ETF buoys crypto market mood

Equally optimistic, trading firm QCP Capital saw favorable market conditions enduring for both Bitcoin and altcoins.

Related: A BTC price breakout ‘never seen before’ — 5 things to know in Bitcoin this week

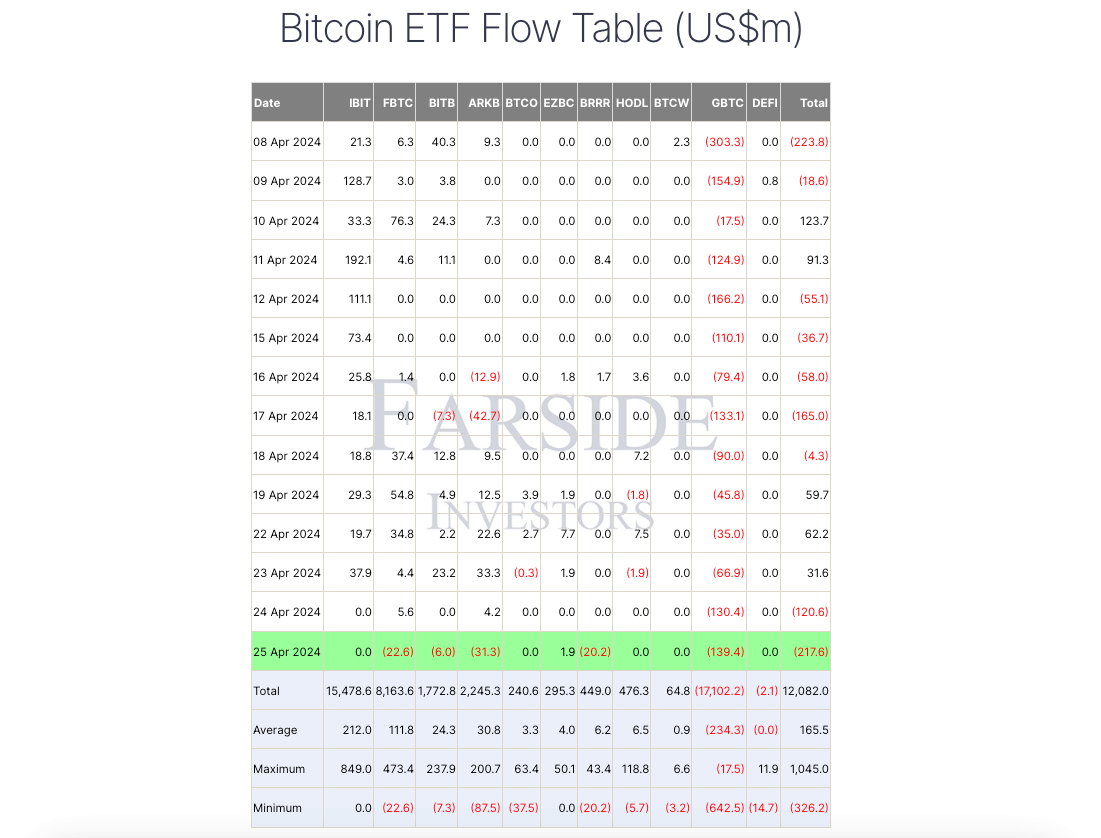

Crypto as a whole, it argued in its latest market update sent to Telegram channel subscribers, would benefit from the final go-ahead and launch of spot Ether (ETH) exchange-traded funds (ETFs) in the United States.

The landmark event is expected this month.

“This bullishness is likely to continue as the market waits for the ETH spot ETF to usher in new demand. The options market certainly reflects this with ETH vols still trading 15% over BTC vols,” it wrote.

“Another reason for persistent bullishness is speculators increasing long positions in other crypto majors in anticipation of additional spot ETF approvals in the near future.”

ETH/USD hit new month-to-date highs of $3,849 at the Wall Street open.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.