Bitcoin price drop below traders’ cost basis warns of deeper sell-off

Bitcoin’s (BTC) price has experienced mounting sell-side pressure, causing it to shed more than 5.5% over the last seven days and setting a six-week low at $58,400 on June 25. During this sell-off, BTC dropped below its short-term cost basis, risking a deeper correction, according to market intelligence firm Glassnode.

“Since mid-June, the spot price has plunged below the cost basis of both the 1w-1m holders($68.5k) and 1m-3m holders ($66.4k),” Glassnode wrote in its “Week On-chain” newsletter published on June 25.

“If this structure persists, it has historically resulted in a deterioration of investor confidence, and risks this correction being deeper and taking longer to recover from.”

Bitcoin short-term holder (STH) cost basis — or realized price — is a metric that represents the average acquisition price of BTC for investors who are considered short-term holders, typically defined by the movement of coins that have been held for less than 155 days.

Data from LookIntoBitcoin reveals that BTC’s breach of the $64,000 level on June 23 saw it fall below the STH realized price at the time, which was $64,591.

In addition, the latest drawdown was inches away from pulling the price below the cost basis of the 3m–6m holders at $57,300, which remains on the rise, even as the price falls.

The report also highlights that the cost basis of the 1w-1m holders has plunged below the 1m–3m cost basis, signaling “a diminishing momentum in the demand side, and a net capital outflow from the asset.”

“During previous bull markets, a negative capital flow structure has occurred up to five times. We can also see that this structure has been in play since May and into early June.”

Spot Bitcoin ETFs see an uptick in inflows

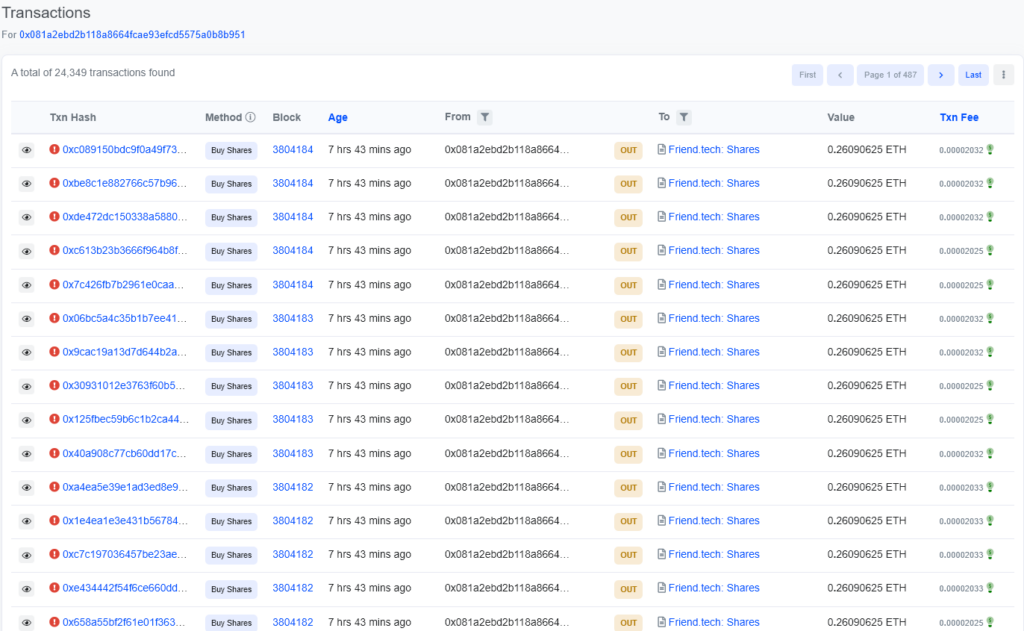

On June 25, the 10 United States-based spot Bitcoin exchange-traded funds (ETFs) saw minor inflows totaling $31 million and ended a seven-day streak of outflows.

Data from SoSo Value reveals that on June 25, Fidelity’s ETF FBTC led net inflows with $49 million, followed by the Bitwise Bitcoin ETF BITB with $15 million in inflows, and the VanEck Bitcoin Trust ETF HODL came in third with $4 million in net inflows.

On the other hand, the Grayscale ETF GBTC had a single-day outflow of $30.2 million, while the ARK 21Shares Bitcoin ETF reported $6 million in net outflows.

As of June 25, the 10 spot Bitcoin funds that began trading on Jan. 11 have seen net inflows of $14.42 billion, with more than $53.56 assets under management.

The massive outflows the spot Bitcoin ETFs witnessed over the last few weeks are the highest since April, when they posted total net outflows exceeding $1.2 billion between April 24 and the beginning of May.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.