Bitcoin price rebound may hit in 10 days as Fed liquidity ‘rips higher’

Bitcoin has around 10 days until United States macro conditions support a return to BTC price upside.

That is according to financial commentator Tedtalksmacro, who tracks the correlation between BTC price action and U.S. Federal Reserve liquidity.

BTC price action strictly correlated to Fed liquidity

Bitcoin (BTC) may be down around 3.2% in June, but the tables may turn before the month is out.

Analyzing how Fed liquidity conditions impact BTC/USD, Tedtalksmacro revealed a close correlation, which has held for several months.

“The correlation between Bitcoin + Fed Liquidity never ceases to amaze me,” he wrote in accompanying commentary on X.

“Liquidity bottoms in the coming 10 days, then rips higher again... get ready.”

A chart from his proprietary macro data resource, Talking Macro, showed BTC price highs and lows syncing with local peaks and troughs in Fed liquidity.

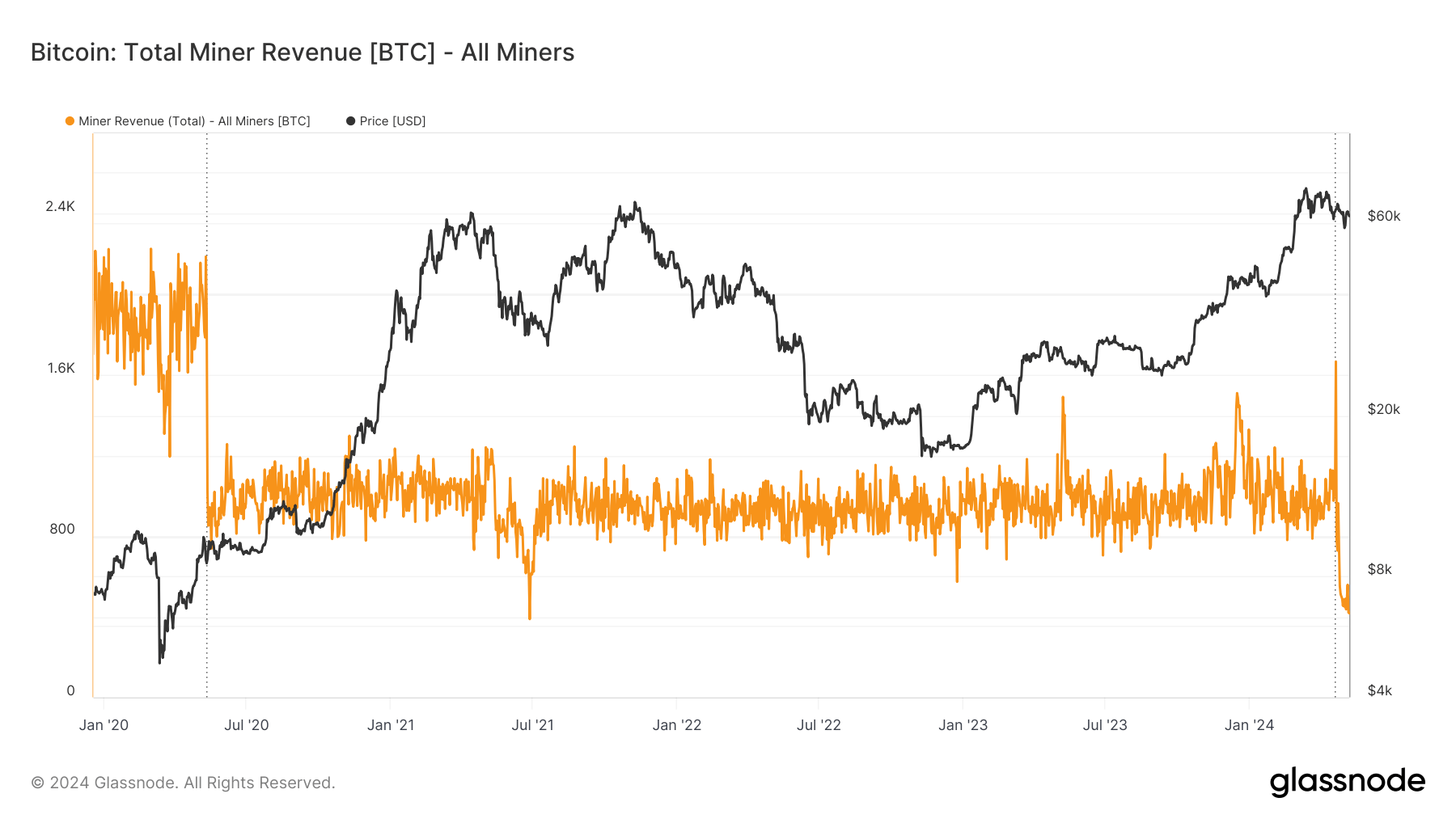

Even Bitcoin’s latest all-time high of $73,800 in mid-March was accompanied by a liquidity spike.

Clarifying how liquidity is calculated, Tedtalksmacro confirmed that the figure is based on “a mixture of Fed assets, repo markets, treasury data.”

Bitcoin ETFs await U.S. wirehouse influx

Talking Macro referred to problematic short-term headwinds for Bitcoin, noting a new decline in inflows to the U.S. spot Bitcoin exchange-traded funds (ETFs).

Related: Bitcoin price uptrend ‘intact’ with hodlers 120% in profit — Research

After seeing their second-highest daily inflows on record in early June, the trend reversed, with the past four Wall Street trading days conversely seeing net outflows.

Data from monitoring resources, including United Kingdom-based investment firm Farside Investors put the four-day outflow tally at just over $700 million — still less than the June 4 $886 million inflow.

Anticipation continues to build for the third quarter and beyond when it comes to a new wave of institutional interest in Bitcoin, as U.S. wirehouses are predicted to gain access to spot ETF products.

As Cointelegraph reported, that event forms a key point on the radar for those eyeing Bitcoin’s continuing transformation into an institutional heavyweight investment class. Among them is Cathie Wood, CEO of asset manager ARK Invest, one of the spot ETF providers.

“No platform has approved Bitcoin yet, so all of this price action has happened before they approve it, and so we haven’t even begun,” she said in an interview in March about U.S. wirehouses.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.