cyptouser1 years ago349

The new group, called the Tokenized Asset Coalition, aims to have real-world assets represented and...

FBI identifies North Korea’s Lazarus Group as culprit in $41M Stake exploit

cyptouser1 years ago480

The FBI revealed in a Sept. 6 report that the North Korean hacking entity Lazarus Group wa...

Former FTX co-CEO Ryan Salame pleads guilty to all charges

cyptouser1 years ago473

Former FTX co-CEO Ryan Salame is expected to plead guilty to the criminal charges against...

Binance linked to money laundering scheme in Belgian extradition case: Bloomberg

cyptouser1 years ago327

Belgian authorities are seeking the extradition of a London-based fintech professional, Caio Marches...

Palau to discontinue dollar-based stablecoin two months after launch

cyptouser1 years ago380

Palau will end the pilot program of its U.S. Dollar-backed stablecoin efforts later this month, acco...

Coinbase insiders dump over $30M stocks amid SEC lawsuit, but share value defies odds

cyptouser1 years ago413

Coinbase top executives have sold more than $30 million worth of the company shares since the U.S. S...

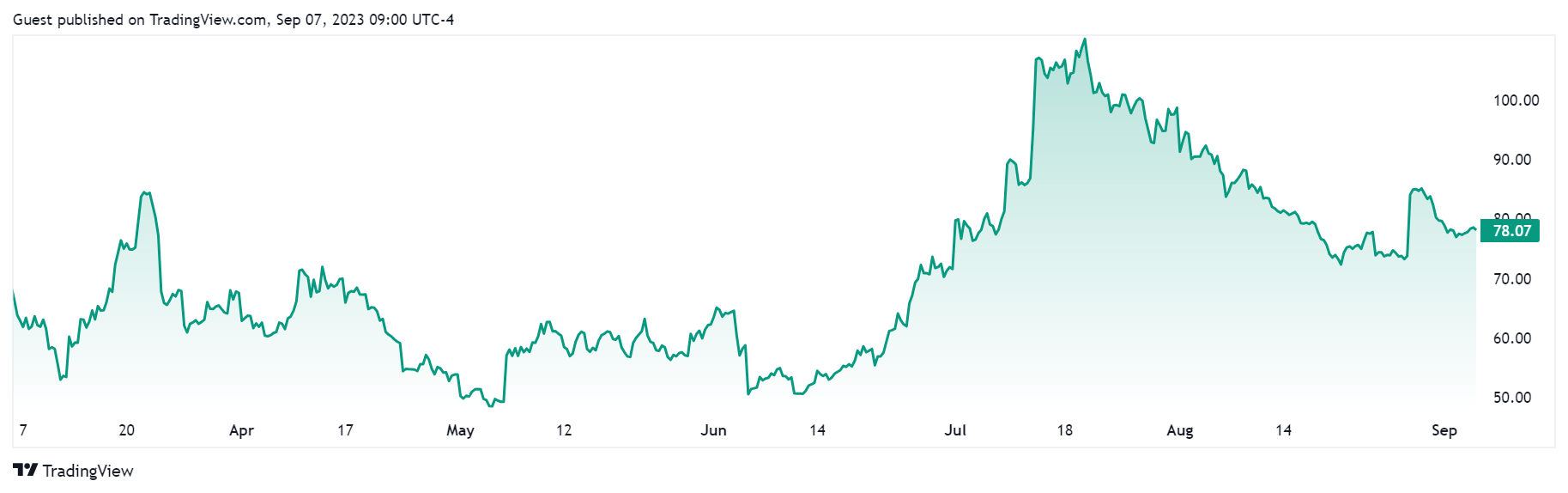

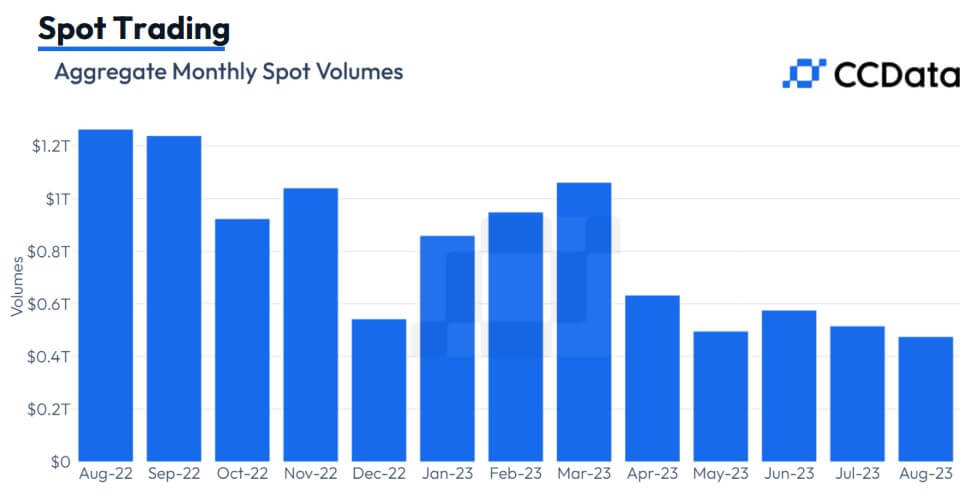

Crypto trading sinks to 2019 levels as Binance sees market dip and Huobi volumes surge

cyptouser1 years ago347

Spot and derivatives trading activities on centralized cryptocurrency exchanges declined for the sec...

Global Stablecoins need governing body, pose risk to financial stability says IMF, FSB in new G20 re

cyptouser1 years ago320

The International Monetary Fund (IMF) and the Financial Stability Board (FSB) published a...

Vitalik Buterin introduces decentralized privacy pools for balancing crypto regulation and anonymity

cyptouser1 years ago371

A new research paper led by Ethereum creator Vitalik Buterin proposes “Privacy P...

Crypto whale loses over $24M staked Ethereum to phishing, as ‘verified’ X scams surge

cyptouser1 years ago464

On-chain data shows a crypto whale “0x13e382” lost $24.23 million worth of liquid staked E...