Coinbase insiders dump over $30M stocks amid SEC lawsuit, but share value defies odds

Coinbase top executives have sold more than $30 million worth of the company shares since the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the crypto exchange on June 6, according to Dataroma.

Armstrong lead sales

Coinbase’s co-founder and CEO Brian Armstrong led the sales with 43 transactions between June 5 and August 1. During this period, Armstrong divested $21.17 million worth of COIN stocks.

Armstrong’s timing in selling his shares, including the sale of almost 30,000 shares in eight transactions just a day before the SEC lawsuit, raised eyebrows from the crypto community. Some believed he might have had advance knowledge of the regulatory action.

However, these suspicions were dispelled as the stock sales were revealed to be part of a pre-arranged selling plan dating back to August 2022 and fully complied with the SEC’s Rule 10b5-1.

CryptoSlate reported that Armstrong’s selling trend had begun in November 2022 when he pledged to sell 2% of his stake at the crypto firm to fund scientific research and development through two startups — NewLimit and Research Hub.

Aside from Armstrong, several other top executives, including the firm’s chief accounting officer Jennifer Jones, chief legal officer Paul Grewal, chief people officer Lawrence Brock, and Director Rajaram Gokul, also divested their shares during this timeframe.

Coinbase stocks unaffected

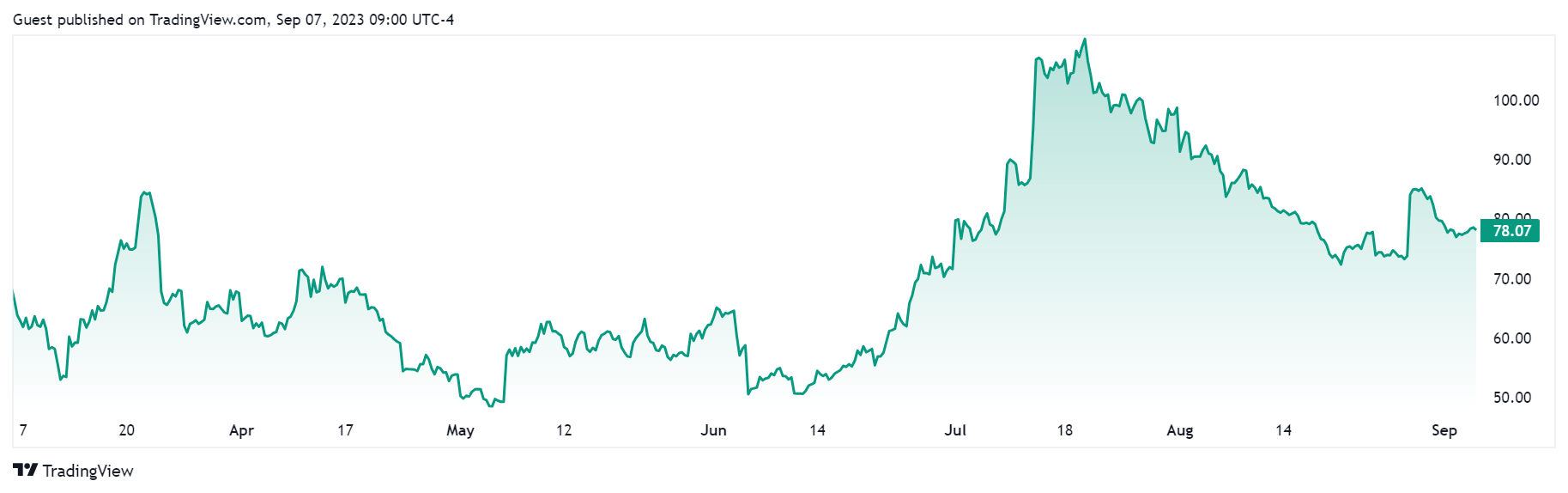

COIN stock remains largely unaffected despite these sales, boasting more than 100% year-to-date increase and a robust 50% gain since the SEC’s lawsuit filing on June 6.

Coinbase’s impressive performance can be attributed to its resolute response to the SEC lawsuit, where the exchange has actively sought a dismissal of the case. Besides that, the exchange has enjoyed support from major stakeholders and several U.S. lawmakers who have questioned the financial regulator’s approach to the crypto industry.

Simultaneously, Coinbase is re-entering the lending arena with a new crypto-lending service tailored for institutional investors. This strategic move aims to leverage the shortcomings of other crypto lenders in the market.