Coinbase, Circle, Aave, and more partner to launch Tokenized Asset Coalition

The new group, called the Tokenized Asset Coalition, aims to have real-world assets represented and circulating on blockchain networks. To that end, the coalition will advocate for the adoption of public blockchains, asset tokenization, and institutional use of DeFi. It will work in three areas: education, advocacy, and adoption.

The coalition said that its efforts aim to bring the “next trillion dollars” of real-world assets onto the blockchain through tokenization. It also suggests that the coalition will grow beyond its initial seven members by attracting future participants.

Crypto industry members are involved

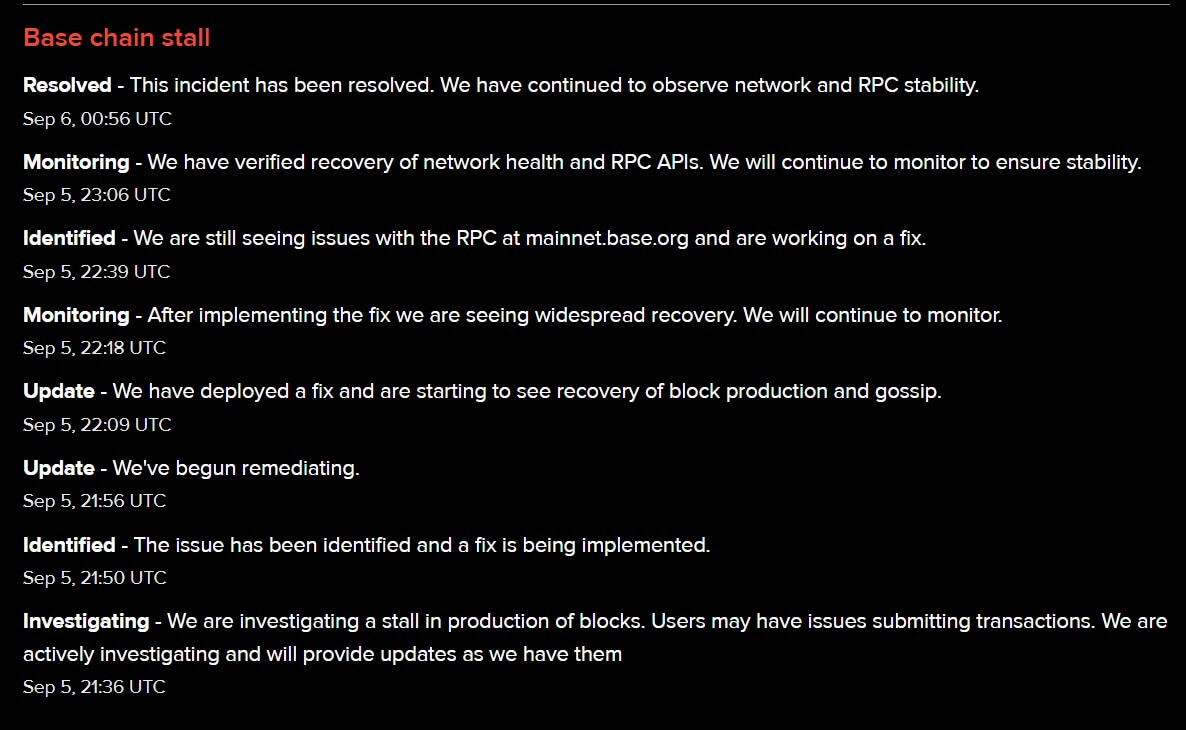

Several notable members of the crypto industry are currently involved in the group. The leading crypto exchange Coinbase and its semi-independent Layer 2 project Base are both among the companies listed as participants in the coalition.

The stablecoin company Circle, which issues the USDC token and is frequently a partner of Coinbase, is listed as another member of the coalition.

The Tokenized Asset Coalition additionally includes the DeFi platform Aave, which commented on its involvement. Aave founder Stani Kulechov said that continued efforts around education and integration are necessary following the successful growth of DeFi. He added that his project “looks forward to working with the Coalition.”

Three credit platforms — Credix, Goldfinch, and Centrifuge — are also members of the coalition, and each has commented on the group’s goals. Credix wrote that public blockchain rails will offer improved efficiency, costs, and transparency in real-world asset transfers. Elsewhere, Goldfinch founder Mike Sall wrote that the effort aims to “harness the transformative power of blockchain and drive its mass adoption.”

Centrifuge, meanwhile, stressed the joint nature of the coalition, writing that the task of bringing the world’s assets on-chain “is larger than that of any single organization.”

RWA.xyz, a platform for real-world asset analytics, is in some ways leading the effort, as it is hosting the coalition website and related materials.