Tether ‘welcomes’ PayPal’s PYUSD stablecoin to the market, says CTO Paolo Ardoino

Paolo Ardoino, CTO of Tether (USDT), said in an Aug. 8 statement shared with CryptoSlate that he welcomed PayPal’s entrance into the stablecoin industry.

Ardoino said PayPal’s foray into the field would enhance the overall growth of the ecosystem as it would drive competing firms to develop solutions that would further boost adoption and innovation.

The Tether CTO added:

Each project strives to differentiate itself by providing unique benefits to users, driving innovation and providing users with more choices and control over their transactions. Fostering competition allows a healthy and diverse market environment.

Ardoino’s perspective resonates with a sentiment echoed by Jeremy Allaire, CEO of Circle and issuer of the USDC stablecoin. Allaire pointed out that PayPal’s foray into the stablecoin field shows how the space would benefit from improved regulatory oversight.

According to on-chain data, 26.9 million of the newly launched PYUSD have been issued to only eight holders, with Paxos and an address (0x264bd8) holding 99% of the stablecoin’s total supply.

Addresses FUD concerns about USDT onboarding

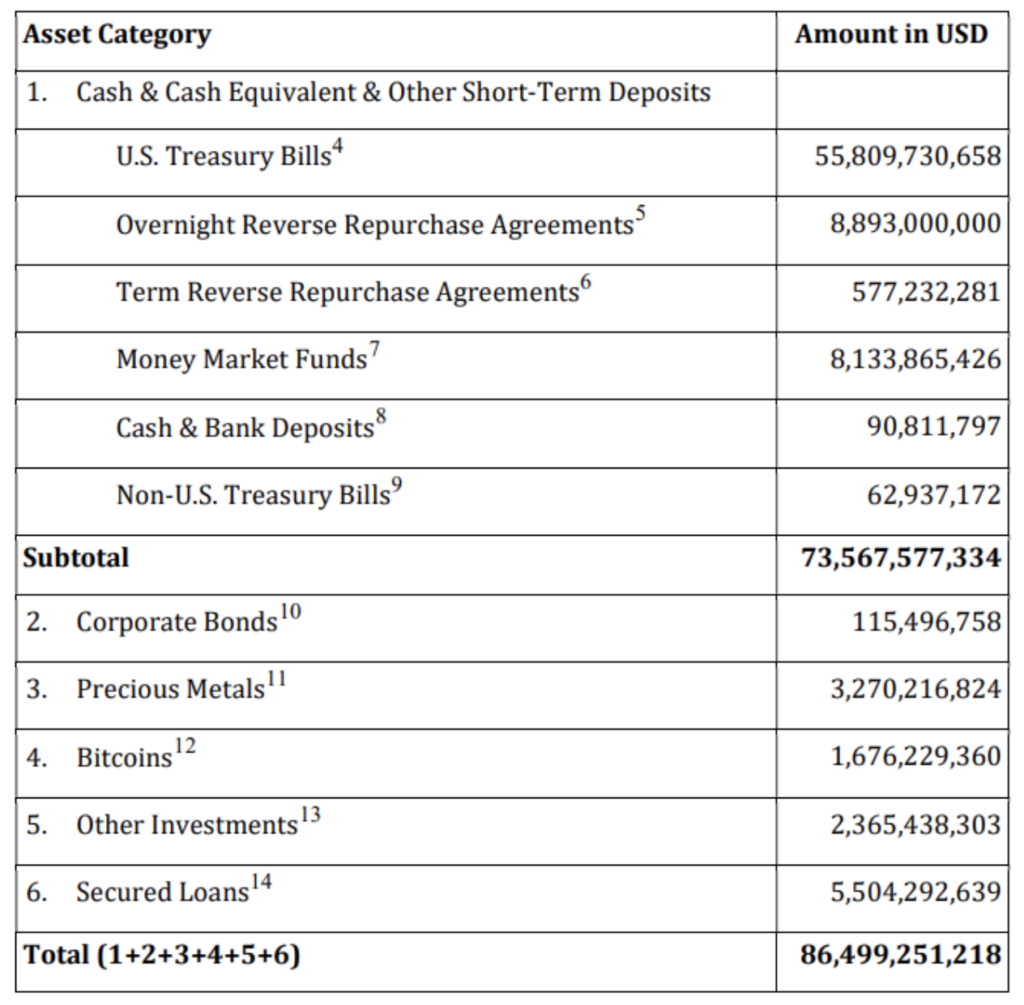

In an Aug. 7 tweet, Ardoino explained why Tether’s onboarding process required strict anti-money laundering and know-your-customer process.

According to him, Tether has banking-grade standards that require users to provide information like “source of funds” and others to avoid putting all its users at risk.

He further stated that Tether is a centralized stablecoin using decentralized transport layers (aka blockchains) and is very different from a decentralized asset like Bitcoin (BTC). He added:

“When you redeem USDt, it means you want to have FIAT back, ie. interact on the banking layer, hence you have to comply with the FIAT system rules.”

However, despite these strict processes, Ardoino noted that the firm was still processing redemptions, revealing that it redeemed around $325 million worth of the assets on Aug. 7

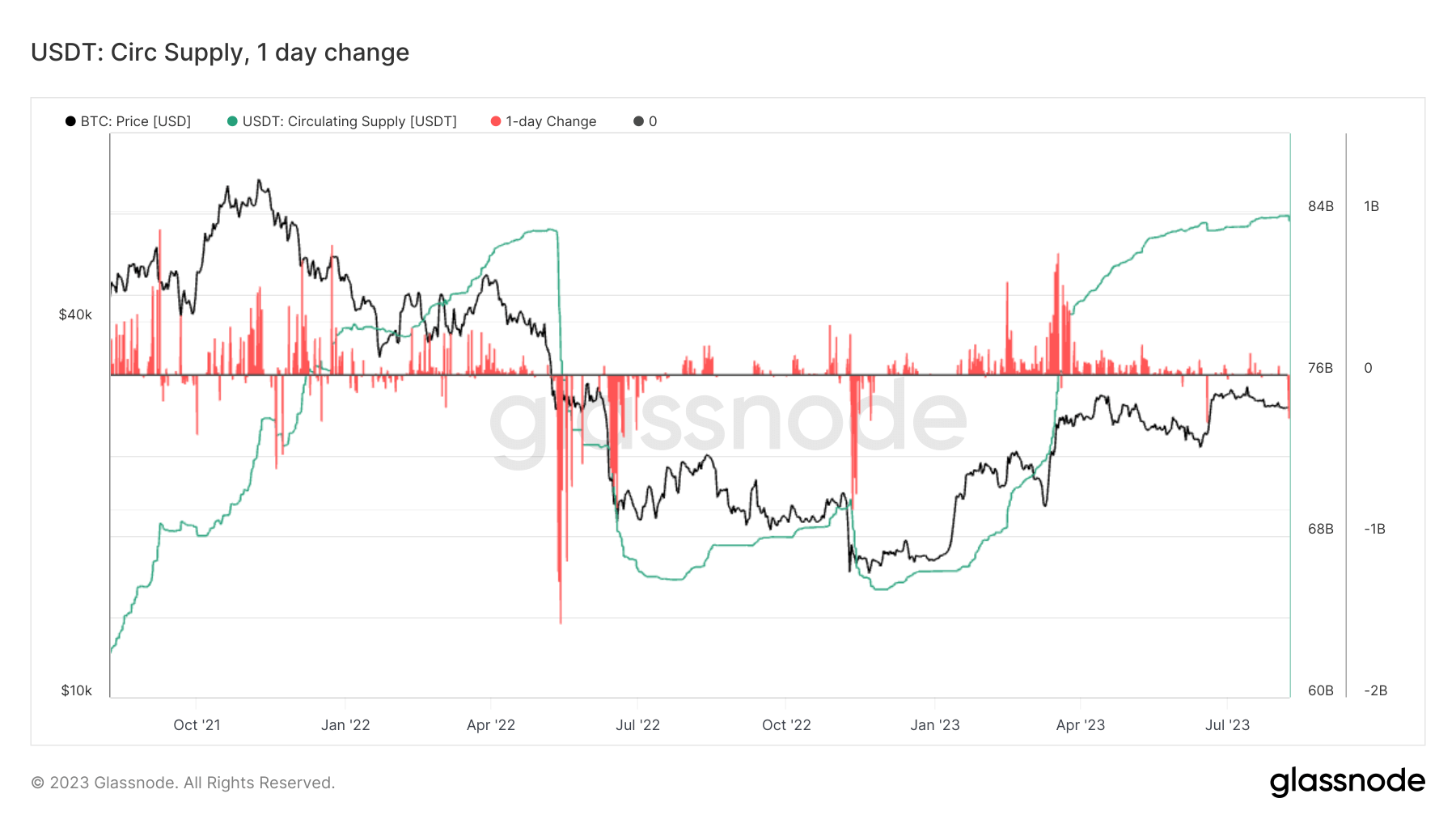

Tether’s USDT is the largest stablecoin by market cap, controlling more than 60% of the entire market, according to CryptoSlate’s data.