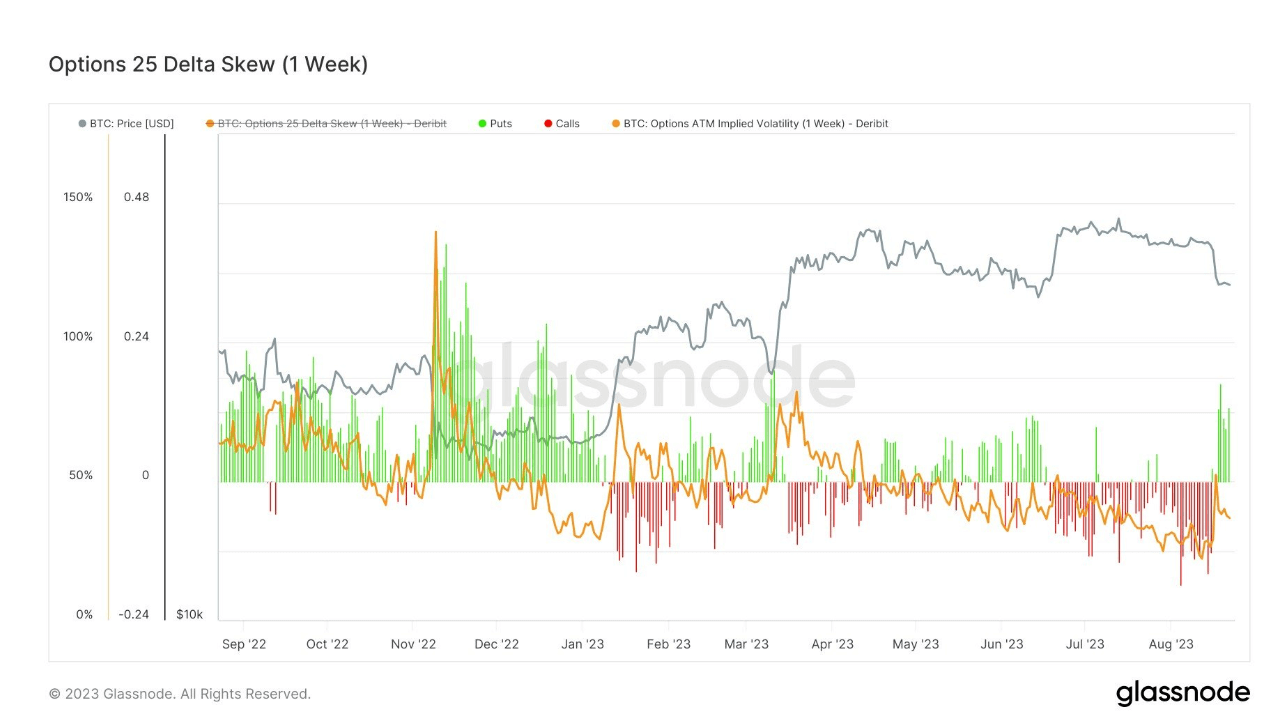

Bitcoin put options see highest demand since March

Looking at the Options 25 Delta Skew on Deribit, the skew, a measure of the relative richness of put versus call options expressed in Implied Volatility (IV), shows a significant uptick in the demand for Bitcoin put options and is presently at its highest level since the SVB collapse in March.

This skew, specifically the 25 Delta Skew, specifically targets options with a delta of -25% for puts and 25% for calls. It represents the market’s interpretation of implied volatility. Computed based on the difference in implied volatility between a 25-delta put and a 25-delta call, normalized by the ATM Implied Volatility, the metric concentrates on option contracts expiring within a week.

The heightened demand for Bitcoin put options is indicative of an increased market sentiment for price declines. While not an absolute metric for market direction, it does highlight heightened caution among some investors regarding potential downside risks.