Historic post-Jackson Hole S&P surges prompt heightened expectations for market responses

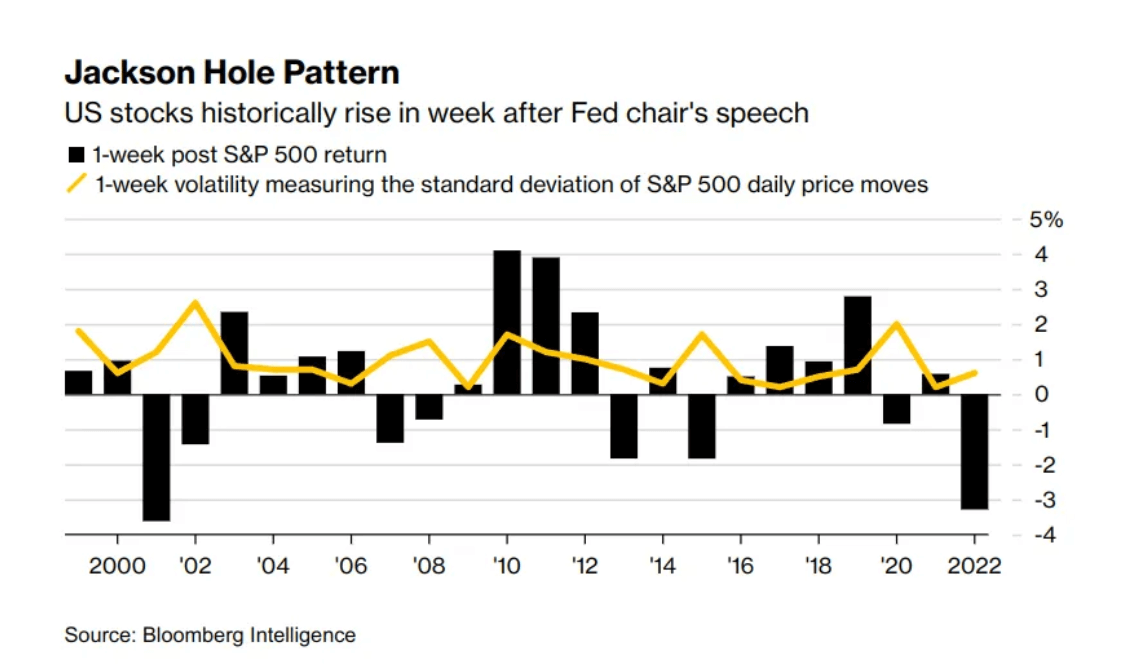

A historical analysis of the S&P index reveals significant market activity after the annual Jackson Hole meeting, which could have implications for the cryptocurrency and blockchain sectors. This comes to light via a comprehensive chart constructed by Bloomberg Intelligence and put together by Markets & Mayhem, indicating a consistent pattern of stock price increases in the week succeeding the meet. The Jackson Hole meeting, a major economic symposium attended by international central bankers and finance ministers, is scheduled for August 24 to 26 this year. The meeting is expected to center on a “structural shift in the global economy,” according to the Kansas City Fed.

These meetings have traditionally sparked a positive response from the S&P since the turn of the millennium. Despite this, it is crucial to note that 2022 marked the worst performance of the index post-meeting since 2001. This deviation from the regular pattern raises questions about the potential market response this year, especially considering the proposed focus on structural economic changes that could drive shifts in the cryptocurrency and blockchain landscape. It underscores the significance of the Jackson Hole meeting’s outcomes and their influence on the direction of the S&P and, by extension, the broader financial market.