Crypto market shakes as Bitcoin futures record 5th-largest single-day decline

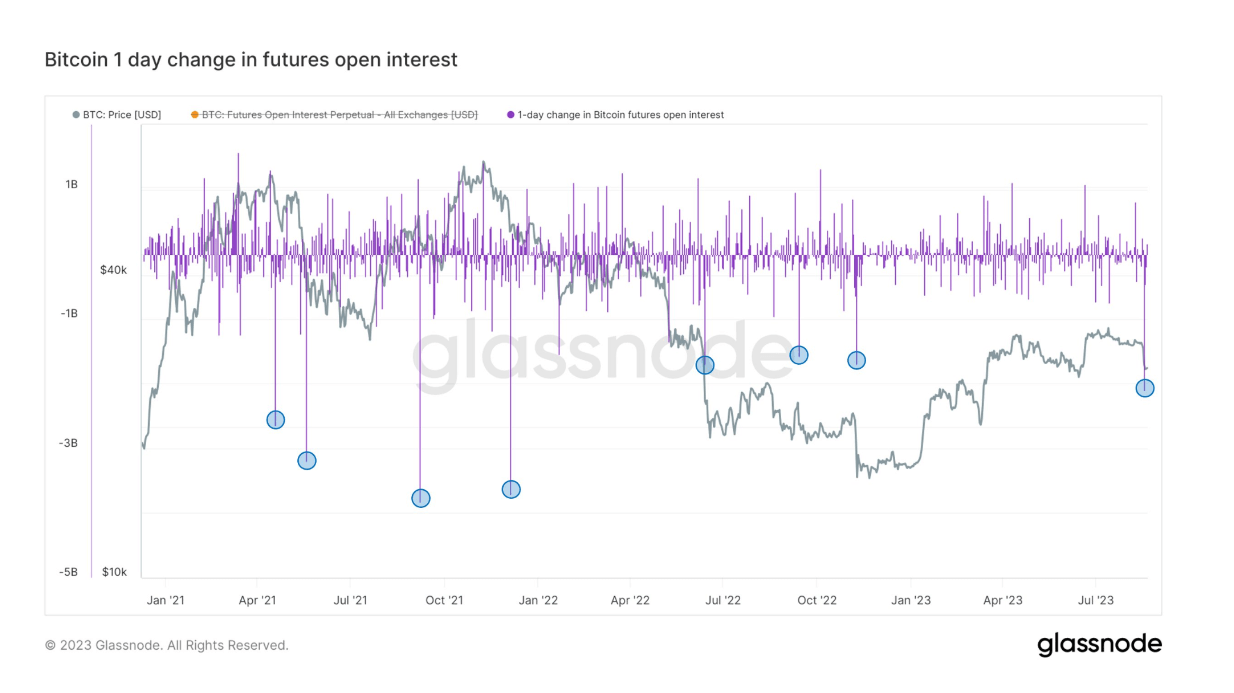

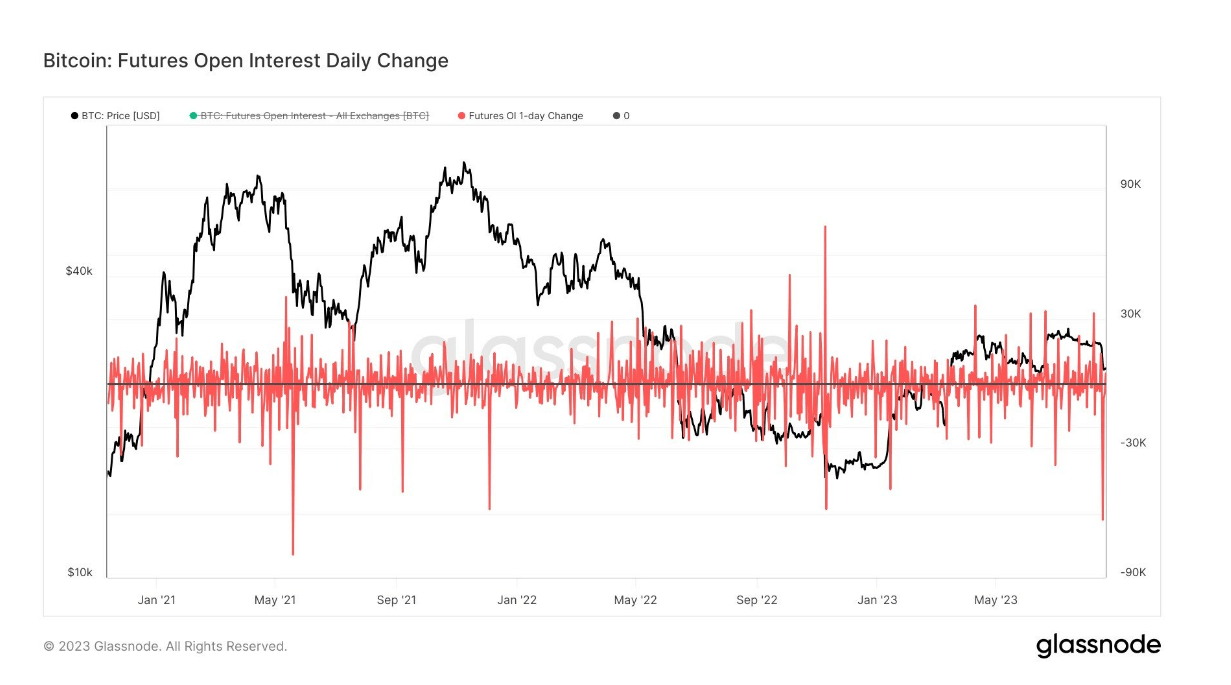

Last Thursday’s cryptocurrency market experienced an extreme event best described as a liquidation cascade. This phenomenon resulted in one of the most significant single-day wipeouts of open interest ever recorded. In terms of the total USD value allocated in open futures contracts, this was the second-largest decrease, underscoring the sheer scale of the event. The fallout from this decline is particularly profound in the realm of Bitcoin futures contract

According to analyst Will Clemente, last Thursday’s event stands as the 5th most significant single-day decline in Bitcoin futures open interest, specifically pertaining to perpetual (non-expiring) futures contracts. This exceptional occurrence underscores the volatility and high-risk nature of the cryptocurrency market, especially within the futures segment.