Ethereum MEV incentives limit decentralization new report shows

On blockchain networks like Ethereum, decentralized validation underpins the entire ecosystem. Yet paradoxically, the highly-technical process of constructing the blocks that store transactions may be quietly accruing influence in the hands of just a few.

According to an analysis by Ethereum researcher Thomas Thiery, block building has evolved into a high-stakes strategic arena. Specialized builders now utilize proprietary algorithms, privileged partnerships, and micro-optimized arbitrage strategies to maximize profits and the probability of block rights.

By quantifying bid timing, latency optimization, order flow sources, and transaction bundles, Thiery’s work exposes the competitive dynamics eroding Ethereum’s decentralized ethos.

The data proves that economic incentives drive builders toward consolidation, cooperation, and specialization in the relentless quest for profits.

According to Thiery, left unchecked, these trends stand to undermine Ethereum’s core value proposition – a world computer operated by a distributed web of stakeholders, not an oligarchy of elites.

Thiery’s research illuminates the reality of block building today, setting the stage for informed dialogue on potential solutions. The coming sections distill vital insights from his analysis into an accessible synopsis for the crypto community.

The lucrative world of block creation

Creating new blocks on blockchain networks like Ethereum is carried out by builders who compete to package transactions into blocks and earn profits in two primary ways:

Collecting Transaction Fees

The first source of revenue stems from packaging transactions into a block and collecting the associated fees. When users submit transactions to the network, they can optionally specify a “gas price,” which compensates the builder for executing their transaction. The total fees collected from all transactions in a block represent one revenue stream for builders.

Optimizing this requires efficiently packing in as many valuable transactions as possible from the public mempool queue. Builders develop algorithms and strategies to maximize the cumulative fee revenue from each block they construct.

Profiting from Arbitrage Bundles

The second, more lucrative revenue source involves arbitrage opportunities that exploit market inefficiencies. Specialized “searchers” identify arbitrages like price discrepancies between exchanges, then bundle the transactions required to capitalize on the opportunity.

These exclusive bundles, often involving a centralized exchange, are transmitted directly to the builder rather than the public mempool. Builders can collect a portion of the profitable spread by including arbitrage bundles in a block.

Some builders form exclusive partnerships with searchers to gain access to these private bundles, which studies indicate provide approximately 80% of total builder revenue. The most common and profitable arbitrage identified involves exchanges between centralized and decentralized platforms.

Strategies for Block Building Supremacy

By leveraging technical expertise and strategic partnerships, blockchain builders employ complex strategies to optimize profits from block construction.

Understanding the incentives and competitive dynamics provides insights into centralization risks and informs mechanisms to improve system decentralization.

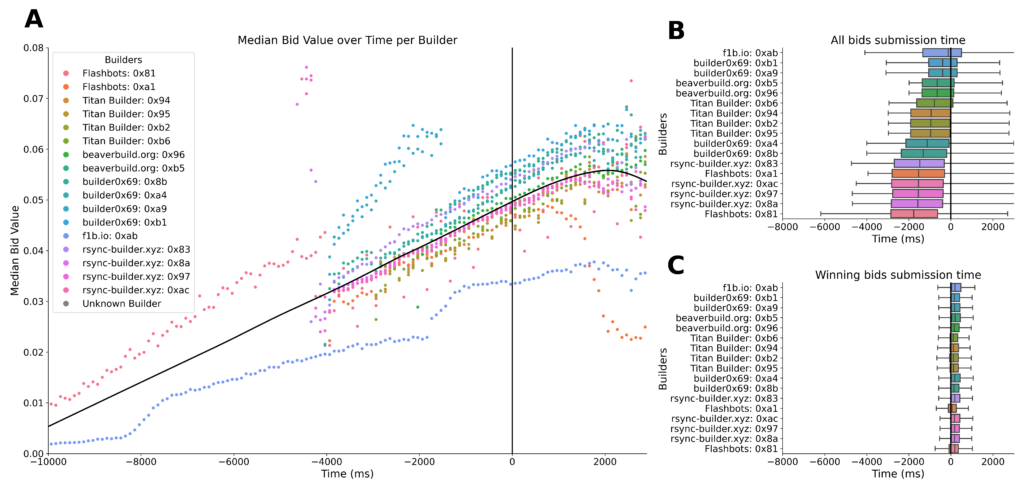

According to Thiery’s examination of block construction dynamics, builders utilize various approaches to maximize their profits and probability of winning block rights. Thiery’s work elucidates builder behavior and its implications by analyzing bid timing, efficiency optimizations, order flow sources, and profitable arbitrage strategies.

Builders increase their bids as Ethereum’s 12-second slot progresses to incorporate additional transactions and extractable value. However, most winning bids occur toward the end of the slot, consistent with consensus protocols.

Builders optimize latency and efficiency differently – some entities submit bids frequently to beat competitors, while others focus on seamless block assembly. Occasional bid cancellations also appear to serve as a tactic for concealing or adjusting value.

Quantifying Centralization Risk

Exclusive transaction bundles from searcher partners account for around 80% of builder revenue, outweighing public mempool transactions. Specifically, Thiery wrote,

“Exclusive transactions represent 30% of the transaction count, but account for 80% of the total value paid to builders. This supports the hypothesis that the majority of valuable transactions generating MEV are packaged into bundles and transferred exclusively from searchers to builders.”

This highlights the importance of strategic partnerships and vertical integration in attaining proprietary order flow.

Arbitrages between centralized and decentralized exchanges proved the most profitable among the transaction types analyzed. One specialized builder won over 60% of these transactions, exemplifying the maximization and centralization risks of over-optimization.

Thiery concludes that quantifying the strategies and behaviors of builders can inform the construction of profiles that evaluate and address centralization tendencies.

The data proves that incentives lead builders toward consolidation, cooperation, and specialization – limiting decentralization. Mechanisms that encourage diversity of techniques and providers may counteract these forces.

Overall, the trends identified by Thiery highlight that prospering in this high-stakes environment necessitates exploiting latency, partnerships, exclusivity, and focus – with implications for global network structure. Understanding these issues can enlighten solutions.

Builders’ Behavioral Profiles (BBPs)

By peering behind the curtain of Ethereum’s block-building ecosystem, Thiery’s work sounds an alarm for the community.

Economic forces and incentives usher this domain toward greater centralization, cooperation, and consolidation amongst profitable entities. Left unaddressed, the drift contradicts the guiding vision of a decentralized world computer.

Yet hope remains – armed with data-driven insights into builder behavior, Ethereum developers and researchers can illuminate the way forward. Thiery posits a Builders’ Behavioral Profiles (BBPs) model with many metrics. These encapsulate bid timing, advancements in latency, bid withdrawal, access to order flow, and MEV strategies and extend to aspects like on-chain and CEX-DEX arbitrages, sandwiches, and liquidation.

Thiery also expressed his hope that the community will amplify the utility of BBPs by integrating new metrics and characteristics to shed light on the function of builders in their interactions with searchers, relays, and validators. According to him, this is a crucial move towards developing sturdy mechanisms that curb tendencies towards centralization and foster an equitable and proficient supply network.

The Ethereum community is yet to respond to the research.