Inflation in the U.S. has shown signs of slowing down, but that doesn’t mean the global market is s

Inflation in the U.S. has shown signs of slowing down, but that doesn’t mean the global market is safe yet.

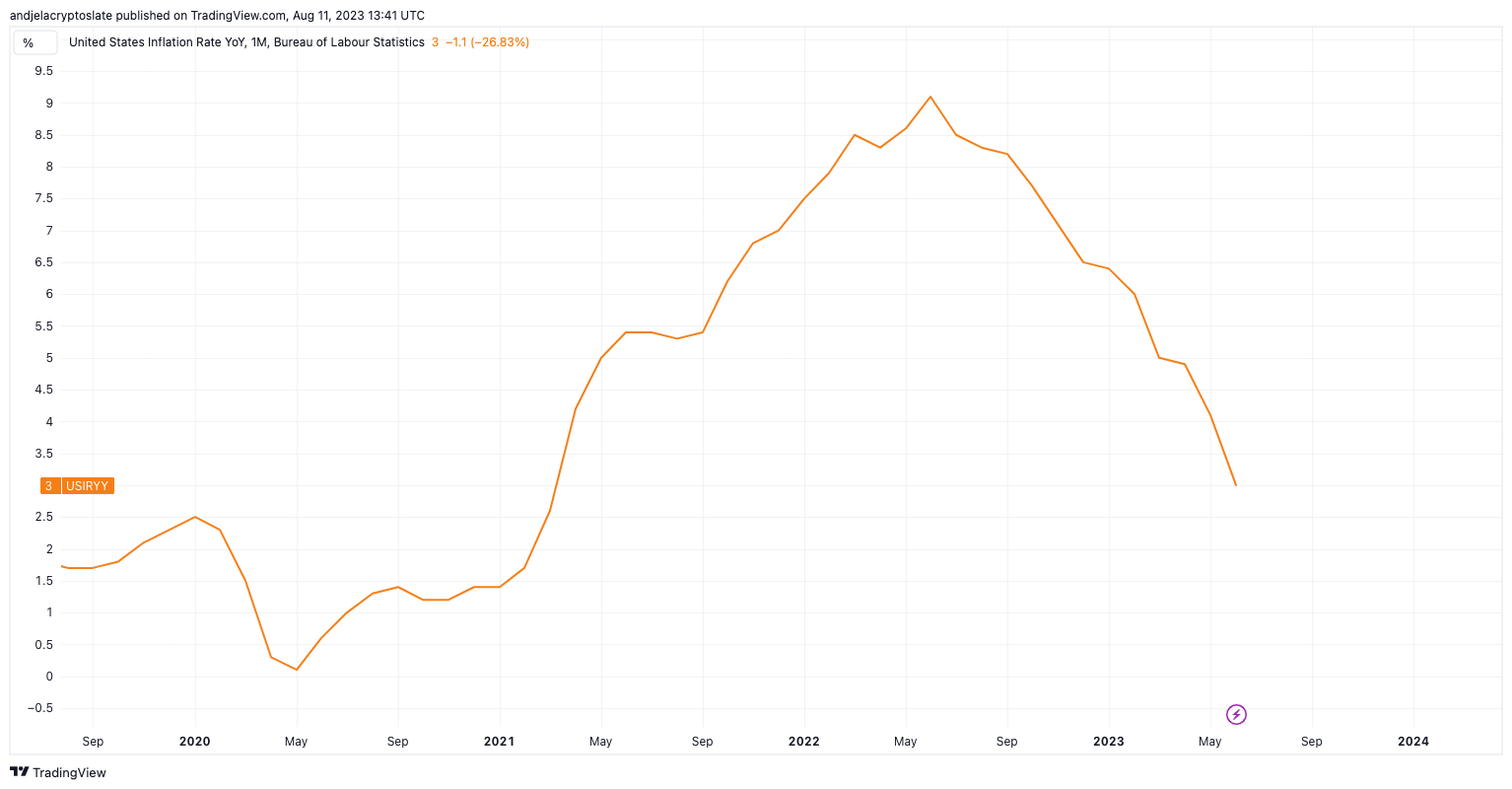

The U.S. inflation rate has experienced a temporary deceleration, dropping on a month-to-month basis. While this trend might seem like a relief to some, economists and market analysts are wary of the underlying factors that could cause inflation to re-accelerate.

Several indicators, including fluctuations in the jobs market, rising food prices, and volatile oil and gas prices, are converging in a complex economic landscape. These factors, coupled with central bank policies and consumer spending patterns, create fertile ground for inflation.

The global market is also showing signs of instability, with changes in key commodities and currencies showing this uncertainty.

The global market is currently facing a complex economic landscape with several indicators pointing towards a potential re-acceleration of inflation. While the U.S. inflation rate has temporarily slowed down, there are several key drivers that could cause inflation to rise again.

One of the primary factors contributing to the potential rise in inflation is the job market. Fluctuations in employment rates can have a significant impact on consumer spending patterns, which in turn can drive up prices. As the job market continues to evolve, it is essential to closely monitor its impact on inflation.

Another key driver is rising food prices. Food is a necessity, and any increase in its cost can have a significant impact on overall inflation rates. Changes in weather patterns, geopolitical tensions, and supply chain disruptions can all contribute to higher food prices.

Volatile oil and gas prices are also contributing to the uncertainty surrounding inflation. The global market is heavily dependent on oil and gas, and any significant fluctuations in their prices can have far-reaching consequences. As geopolitical tensions continue to rise, it is essential to monitor the impact on oil and gas prices and their potential impact on inflation.

Central bank policies also play a crucial role in determining inflation rates. Interest rates, money supply, and other monetary policies can significantly impact consumer spending patterns and overall inflation rates. As central banks continue to navigate the economic landscape, it is essential to monitor their policies and their potential impact on inflation.

Consumer spending patterns are also a critical factor to consider when analyzing inflation rates. As consumers spend more money, demand for goods and services increases, which can drive up prices. Monitoring consumer spending patterns can provide valuable insights into potential inflation rates.

The global market is currently showing signs of instability, with changes in key commodities and currencies contributing to this uncertainty. As the economic landscape continues to evolve, it is essential to closely monitor these indicators and their potential impact on inflation.

In conclusion, while the U.S. inflation rate has temporarily slowed down, there are several key drivers that could cause inflation to rise again. Fluctuations in the job market, rising food prices, volatile oil and gas prices, central bank policies, and consumer spending patterns all play a crucial role in determining inflation rates. As the global market continues to evolve, it is essential to closely monitor these indicators and their potential impact on inflation.