NFT thefts decline as FBI exposes new developer impersonation scams

The U.S. Federal Bureau of Investigation (FBI) warned that criminals were posing as Non-Fungible Token (NFT) developers in financial fraud schemes despite the declining number of NFT crimes and token thefts.

The FBI stated that these malicious actors execute their schemes through a dual-pronged approach: either by infiltrating the social media profiles of authentic developers or by crafting nearly identical accounts.

The bad actors endorse fraudulent NFT releases from these social media accounts while concealing their ulterior motives with an aggressive media campaign to create a sense of urgency with phrases like “limited supply, surprise, exclusive mints,” etc.

Once an unsuspecting individual buys into the scheme, they are lured to a fake website via phishing links, where they are urged to connect their crypto wallets to purchase digital assets. The FBI wrote that this usually results in the “transfer of cryptocurrency and NFTs to wallets operated by criminals.”

The law enforcement agency added that the criminals tend to obfuscate their transaction trails by sending the stolen cryptocurrencies through a series of cryptocurrency mixers and exchanges.

NFT thefts declining

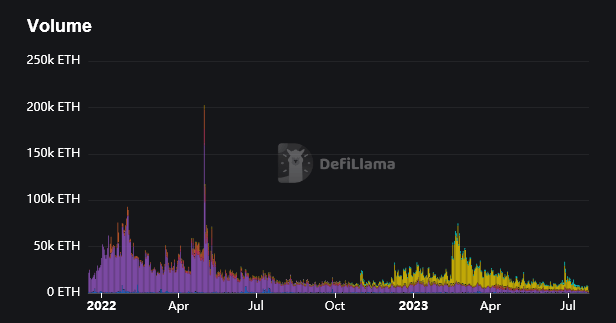

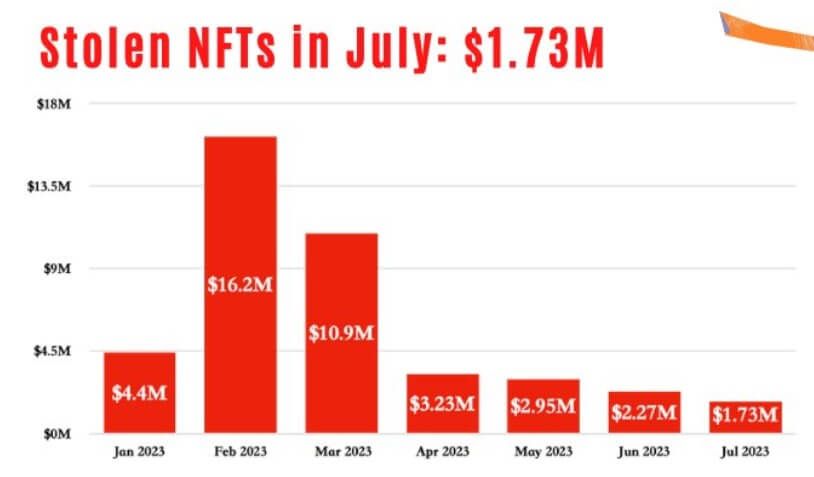

On Aug. 6, blockchain security firm PeckShield reported that the number of stolen NFTs declined by 31% in July to $1.73 million. This is a significant reduction from the $2.27 million NFT thefts recorded in June.

PeckShield stated that half of the stolen NFTs were sold on various marketplaces within 2 hours of the theft. Most were sold on Blur and OpenSea, the dominant NFT marketplaces.

Meanwhile, a closer look at the numbers showed that NFT thefts have decreased since the beginning of the year. Apart from February and March, when nearly $27 million worth of assets were stolen, other months have recorded less than $5 million worth of thefts each, according to PeckShield data.

Market observers suggest that the declining trend indicated that NFT thefts might not be as lucrative as they previously were because the floor price of several blue-chip collections has suffered in the current market condition.