Binance drops support for Sandbox NFT staking, will soon end support for all Polygon NFTs

Leading crypto exchange Binance said that it will end support for features related to non-fungible tokens (NFTs) on Sept. 9 and for all Polygon-based NFTs on Sept. 26.

The company asked users to withdraw Polygon NFTs by Dec. 31. It said that users will not be able to buy Polygon NFTs after Sept. 26 and that all listings will be canceled that day. It added that Polygon NFTs will be returned to user accounts after Sept. 28.

Binance also said it would discontinue its Sandbox NFT Staking Program, which previously allowed users to stake LAND tokens and earn SAND rewards in connection with a popular Polygon-based metaverse game, The Sandbox.

That staking program will end on Sept. 26, and Binance will automatically unstack users’ LAND NFTs on Sept. 27. Those tokens will be sent back to users’ Binance accounts on Sept. 28, and the final staking rewards will be distributed that same day.

Binance said that the service reduction is the result of “consideration and evaluation” and part of its attempts to “streamline” its services. It did not comment on whether trading volumes or user demand affected its decision to end those services.

Binance introduced its NFT marketplace in April 2021. It added support for Polygon-based NFTs more recently on March 8, 2023, and it introduced its Sandbox staking program just over one month later on April 28, 2023. As such, each feature was very short-lived and available to customers for six months or less.

Binance’s NFT marketplace currently supports three other networks: Ethereum, BNB Chain, and Bitcoin. The company added support for Bitcoin Ordinals in May.

Polygon (MATIC) will remain listed on Binance

There is no indication that Binance intends to delist Polygon’s MATIC token from its main exchange. Binance is a major exchange for MATIC trading: it handled at least $37 million of MATIC’s $181 million trading volume over a 24-hour period on Sept. 8.

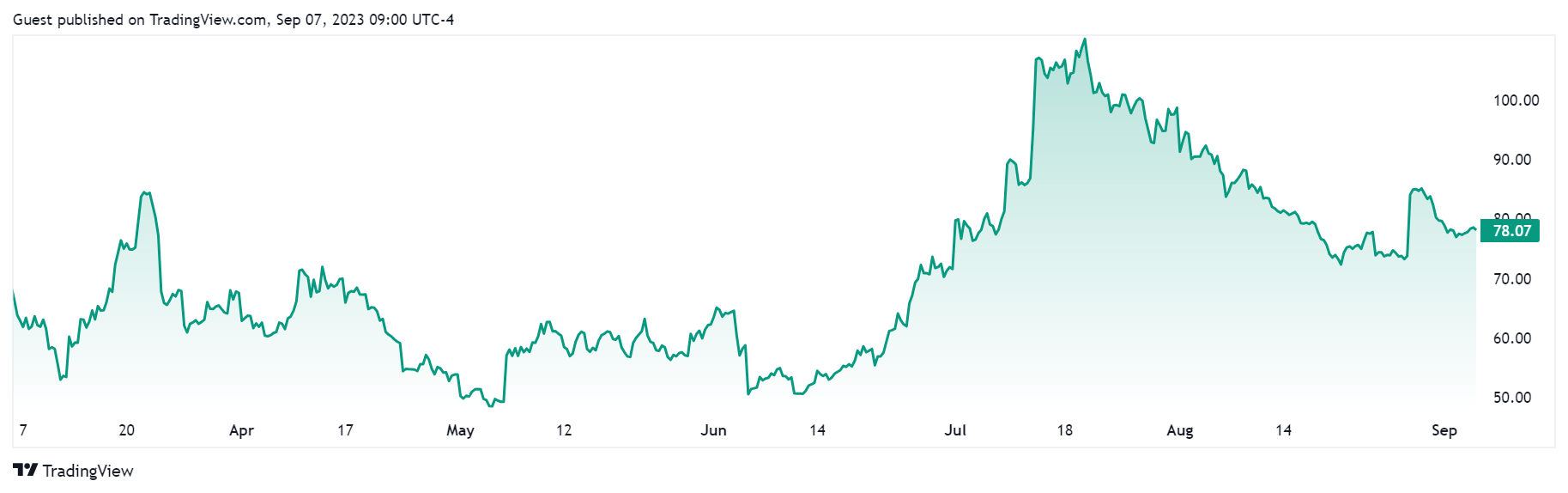

MATIC is the 14th largest cryptocurrency by market cap, with a total supply worth $5.05 billion. It is down 1.7% over 24 hours, while the crypto market is down 0.3%.