Bitcoin user’s costly error leads to record transaction fee of $510,000

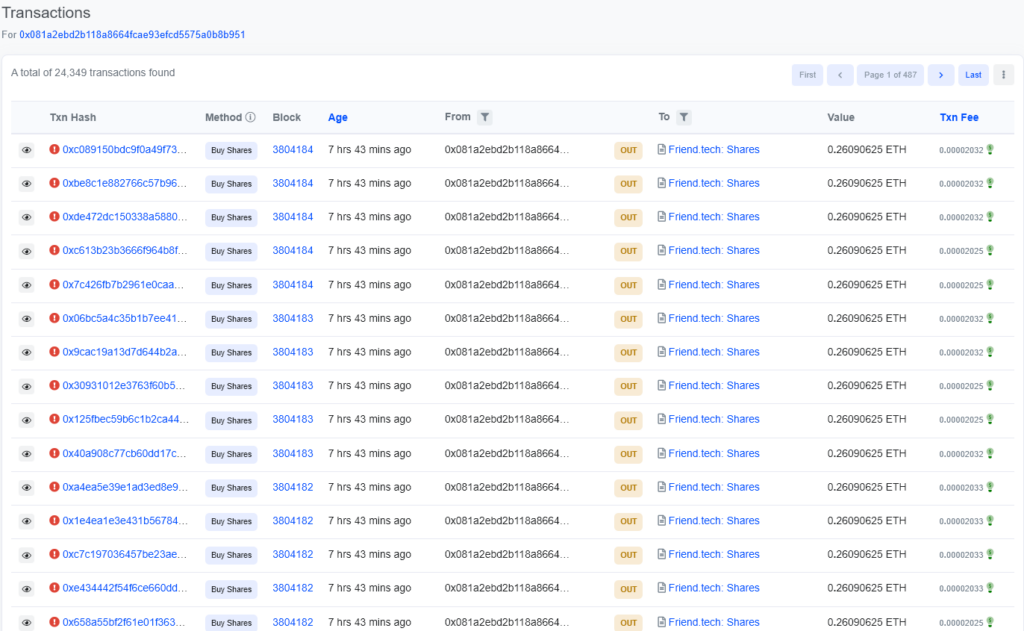

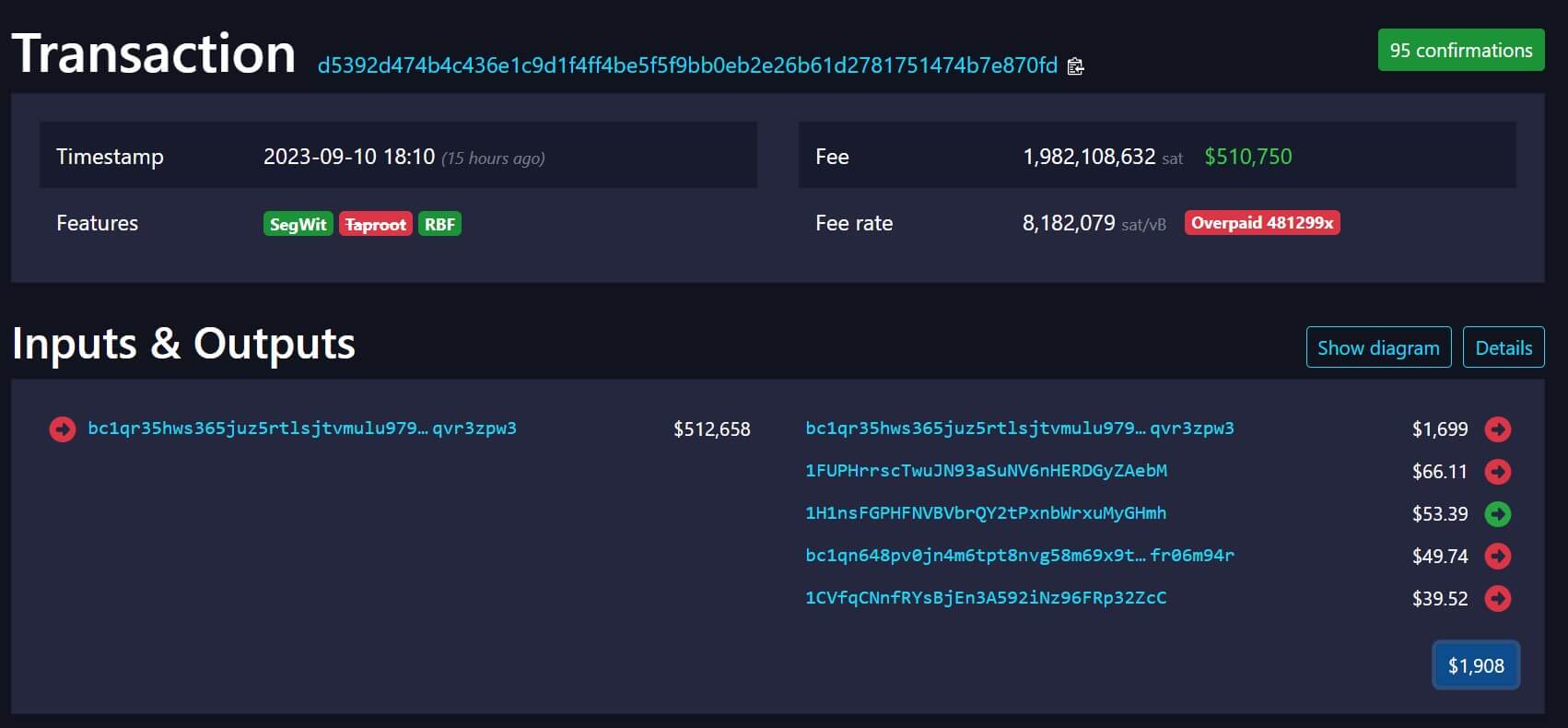

According to on-chain data, a Bitcoin user spent a staggering 19 BTC, around $510,000, in transaction fees for transferring a mere 0.074 BTC, valued at less than $2,000, on Sept. 10.

The average transaction fee on the blockchain network was $2.176 as of press time, per data from ycharts.com. Per mempool, the user overpaid more than 480,000 times for the transaction, making the fee the highest ever recorded on the Bitcoin network.

Jameson Lopp, the co-founder of CasaHODL, who analyzed the incident, noted that the fat finger error might be due to buggy software from an exchange or payment processor address.

According to Lopp, the address has received and sent more than 60,000 transactions and likely miscalculated the change output, causing transaction fee errors.

“The address in question that made the fee calculation error has the characteristics of a withdraw-only hot wallet from an enterprise. It looks like it only receives deposits from one address to top up its balance now and then,” Lopp added.

Chun Wang, co-founder of F2Pool, said the 20 BTC fees will be temporarily held. The user responsible for the transaction has a three-day window to claim these fees. However, if no one comes forward to claim them, miners will redistribute the fees.

This decision aims to address the unclaimed fees fairly and equitably.

Interestingly, it appears the user has not noticed the mistake, as they are still sending transactions from the wallet.