Arkham Intelligence uncovers nearly all of MicroStrategy's on-chain Bitcoin holdings

Crypto Intelligence firm Arkham Intelligence has reportedly identified on-chain addresses containing 98% of MicroStrategy’s Bitcoin holdings.

According to a Feb. 16 post on social media platform X (formerly Twitter), MicroStrategy, which recently repositioned itself into a BTC development company, holds 107,000 BTC of the top digital asset with Fidelity, while 79,000 BTC is held in segregated custody, including Coinbase Prime.

“107,000 appears to be held with Fidelity pooled with other clients’ BTC, hence is included in our Fidelity Custody entity. The remaining 79,000 held in segregated custody including Coinbase Prime, is in our new Microstrategy entity,” Arkham Intelligence wrote.

Arkham explained that Fidelity Custody combines client funds through an omnibus custody model. Notable clients include the FBTC exchange-traded fund (ETF) and MicroStrategy. According to Arkham’s dashboard, Fidelity Custody holds over 176,000 BTC, valued at over $9 billion.

Arkham is the first crypto company to identify these addresses publicly.

This revelation follows Arkham’s recent claim of identifying the on-chain addresses of several spot BTC exchange-traded funds (ETF) in the United States. The crypto intelligence firm had previously identified the addresses of significant entities like Grayscale Bitcoin Trust (GBTC) before its conversion into an ETF and addresses belonging to the crypto trading platform Robinhood.

MicroStrategy’s BTC

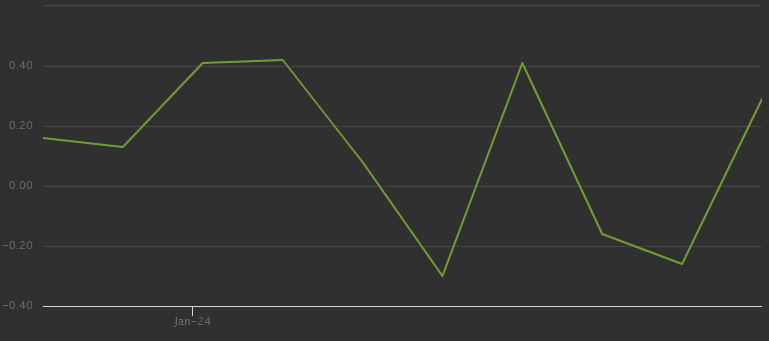

MicroStrategy is the largest corporate holder of the top crypto asset, and its holdings briefly topped the $10 billion mark recently. Saylortracker data shows that the company’s 190,000 BTC is currently worth $9.89 billion and has an unrealized profit of $3.9 billion.

The company’s executive chairman, Michael Saylor, is a vocal advocate for Bitcoin and recently said:

“BTC represents the digital transformation of capital. Money is flowing out of 20th century analog assets into the digital economy at an increasing rate. BTC is digital property protected & transmitted by digital power.”

Meanwhile, MicroStrategy’s BTC investment has boosted its stock performance, with MSTR slowly increasing toward being eligible for inclusion on the S&P 500 index.