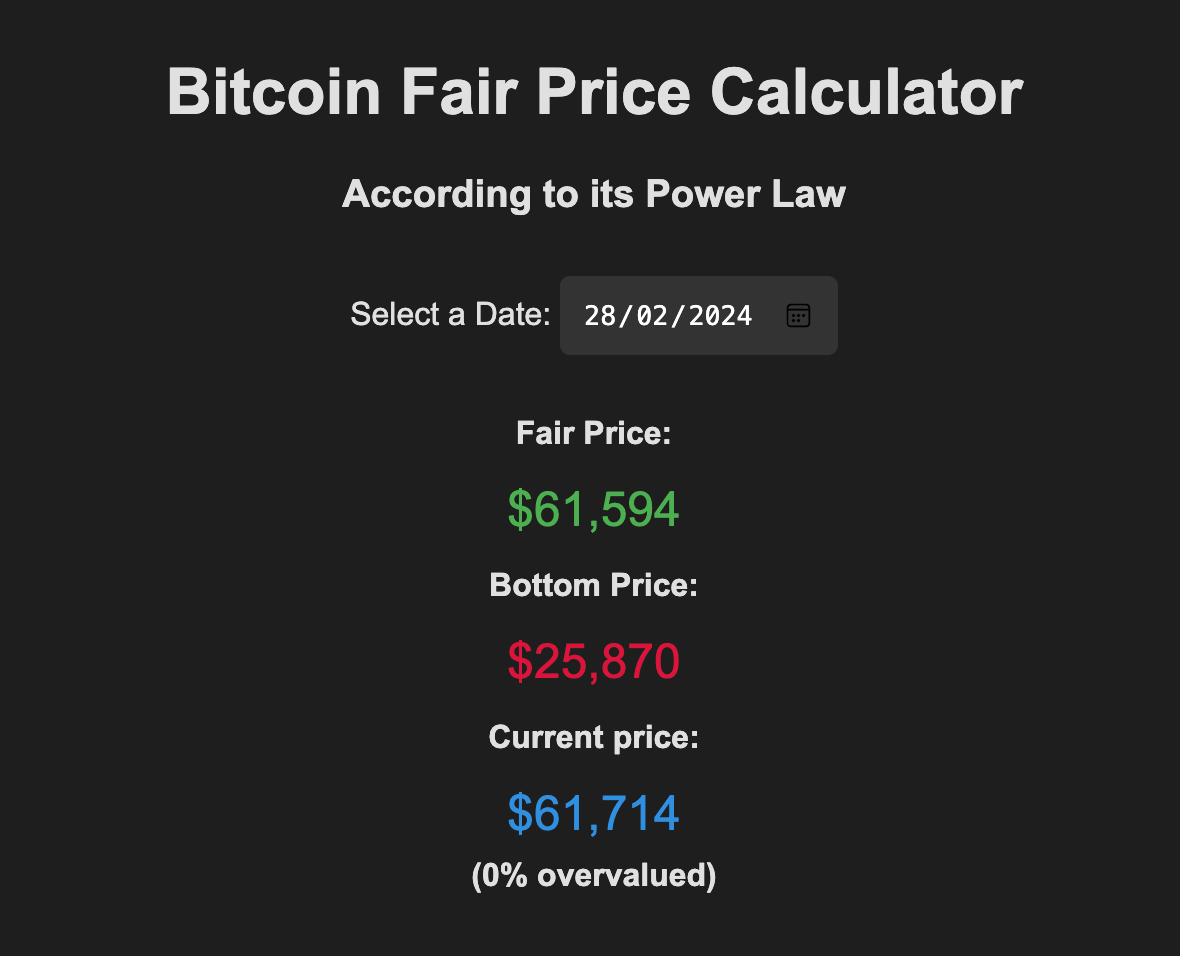

At $61,594 Bitcoin is at fair market price according to the power law model

On a monumental day for Bitcoin, where it opened at $56,900, the flagship digital asset has officially exited the bear market according to the Bitcoin Power Law model. After surpassing $61,000, it has now reached the ‘fair price’ of $61,594, aligning with the projected power law price.

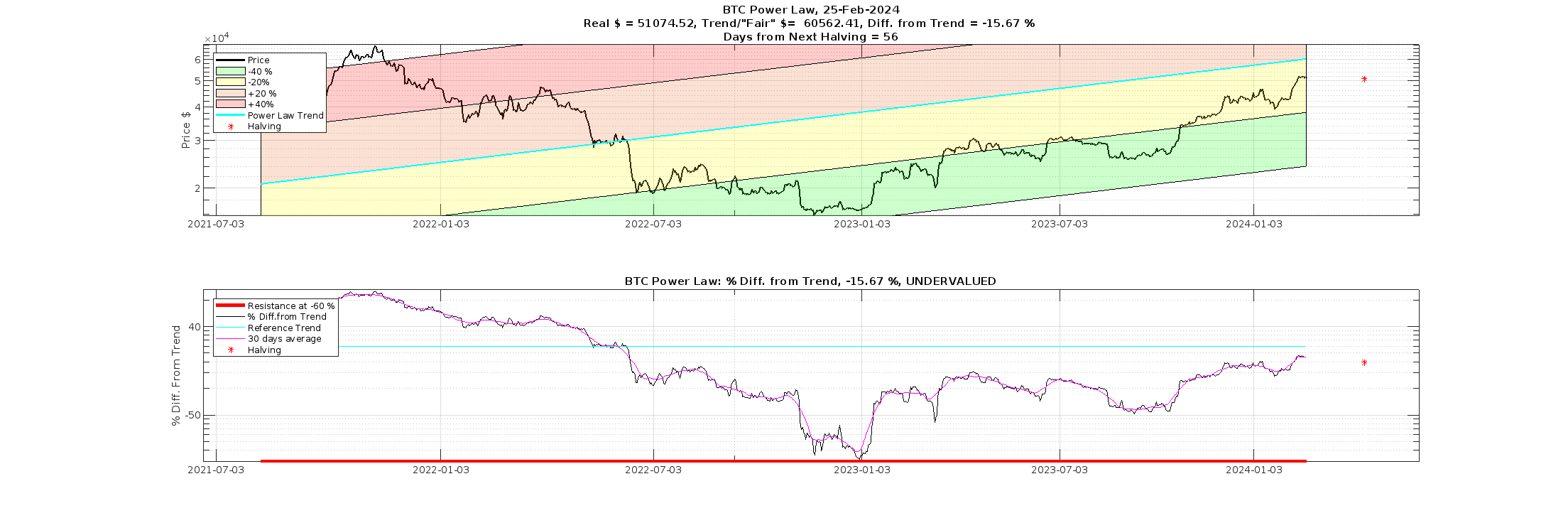

First posited by Giovanni Santostasi, the Bitcoin Power Law is a model that attempts to predict Bitcoin’s long-term price trajectory based on its historical tendency to follow a roughly straight line when plotted on a logarithmic scale. This pattern suggests an underlying pattern to Bitcoin’s growth.

The model distinguishes between “fair price” (the trend line representing an average valuation) and “bottom price” (historically about 58% below the fair price, indicating a potential floor). These values are calculated using a formula based on the number of days since Bitcoin’s creation (Genesis Block) and a specific exponent:

Fair Price = 1.0117e-17*(days since Genesis Block)^5.82.

The chart below shows a section of the power law model and its relative fair price as shared by Santostasi on Feb. 25. Bitcoin has since passed the current ‘fair price,’ indicating it is heading toward the bull market ‘bubble’ identified as a key component of each Bitcoin halving cycle within the power model.

Within the power law model, the price deviates from the ‘fair value’ above and below during bull and bear markets but ultimately returns to the fair value over time. Historically, the model has been highly accurate. However, it’s important to note that this is a model, and while it has held up surprisingly well at times, market forces can change, and the model cannot account for all factors potentially influencing Bitcoin’s price.