Binance discontinues leveraged tokens amid a quiet market share rebound

Crypto exchange Binance announced discontinuing trading and subscription services for its leveraged token offerings, including Bitcoin, Ethereum, and its BNB Coin, effective Feb. 28.

According to the Feb. 19 statement, the exchange will delist these tokens and halt redemption by April 3. The affected leveraged tokens are BTCUP and BTCDOWN, ETHUP and ETHDOWN, and BNBUP and BNBDOWN.

Users are urged to trade their tokens before the Feb. 28 deadline. Afterward, tokens can still be redeemed via the wallet function or on its website. These assets would be automatically converted into USDT after the delisting period.

Binance Leveraged Tokens are derivative products representing a basket of perpetual contract positions that give users leveraged exposure to the underlying asset. Like other tokens, these assets can be traded via the spot market.

Thus, they allow the exchange users to participate in derivative trading without tweaking their trading strategies. However, these assets also carry some inherent risks.

Though Binance didn’t specify the rationale for discontinuing these services, it stated that it was focused on delivering optimal value to customers and maintaining competitiveness.

Binance silent resurgence continues

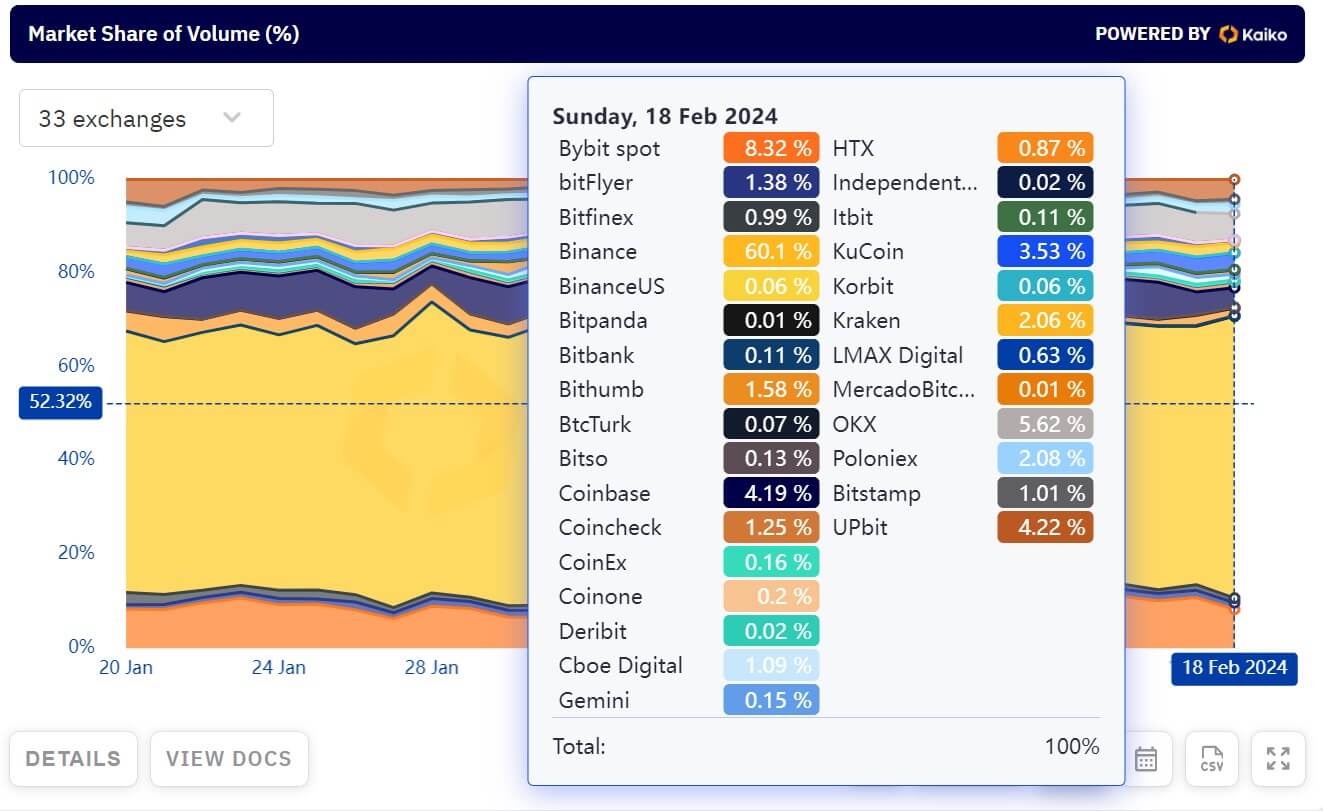

Further, Binance’s market share is quietly rebounding to previous peaks following regulatory challenges that affected its operations last year.

The platform exited, or partially exited, several regions, including Canada, the United Kingdom, and various European countries like Austria, Cyprus, and the Netherlands, due to these regulatory concerns. Additionally, it settled with US authorities for $4.3 billion, causing its market share to drop to 44.5% by the end of the year.

However, Kaiko data show that its numbers are improving, with the exchange controlling more than 60% of the market share volume as of Feb. 18. Earlier in the month, CyptoRanking Insight pointed out that the firm had overtaken CME as the leading exchange in terms of Bitcoin futures open interest.