Chainlink exec says leading banks have begun tokenizing real world-assets

Chainlink Labs is guiding major financial institutions towards adopting blockchain technology and tokenization, which is already underway, according to Niki Ariyasinghe, Head of Business Development for Asia-Pacific and the Middle East.

During a recent talk, Ariyasinghe shared insights into this transformative journey, emphasizing the industry’s pivot from pilot programs to full-scale production deployments.

Real Transactions, Real Impact

According to the Chainlink executive, the move toward tokenization is not speculative; it’s already in full swing.

Leading banks worldwide are actively preparing to harness the vast opportunities presented by tokenization, transitioning from successful testnet pilots to launching their platforms on the mainnet, essentially laying the foundation to support trillions of dollars in tokenized assets.

Ariyasinghe said that the adoption of blockchain for real-world transactions is already underway and pointed to Broadridge as an example. The company has launched a blockchain-based repo platform that handles over $70 billion daily transactions.

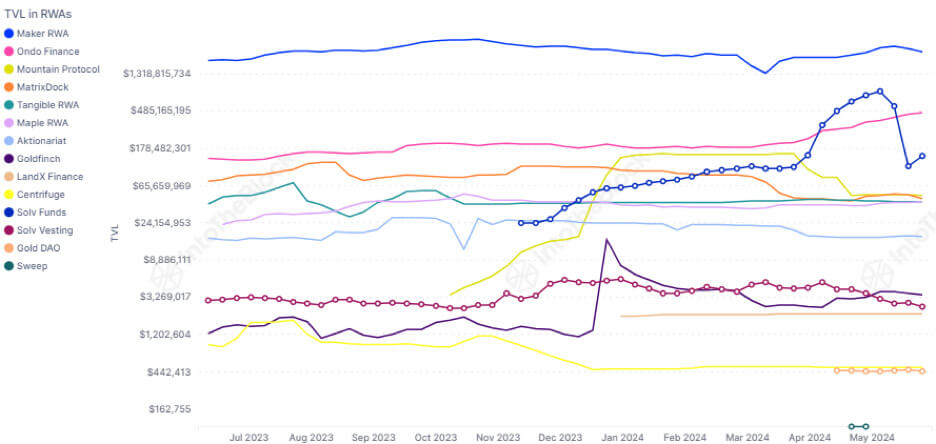

Such platforms showcase the tangible impact of blockchain technology, hinting at a future where real-world assets (RWAs) are increasingly digitalized across various verticals.

Supporting tokenization

Ariyasinghe said that Chainlink provides a platform that integrates data, computation, and cross-chain functionalities, which is essential to fully leverage tokenized assets.

He added that over 40 institutions worldwide are working with Chainlink Labs, focusing on live transactions with real value on the blockchain. This includes financial giants like Goldman Sachs, Citigroup, and HSBC, which are actively developing tokenization platforms in preparation for the opportunities ahead.

According to Ariyasinghe, the next few years are expected to see a rise in transactions across specific sectors, leading to significant volumes moving onto blockchain platforms.

The trajectory outlined by Ariyasinghe predicts a gradual build-up to 2024 and 2025, which will lead to a surge in vertical-specific activities, propelling significant volumes onto blockchain platforms.

This momentum is expected to accelerate post-2026, marking a new chapter in financial technology where blockchain and tokenization become integral to global financial systems.