Ethereum breaks 22-month record crossing $3000 amid positive market speculations

Ethereum’s price soared to a noteworthy milestone in the past day, briefly crossing the $3,000 mark for the first time in 22 months.

During this period, ETH’s price peaked at approximately $3,025, marking a remarkable 27% surge over the last 30 days. However, its value has retraced slightly to around $2,920 as of press time, experiencing a 3.5% dip, according to CyptoRanking’s data.

Why did ETH rise?

ETH’s recent price surge is widely attributed to speculation surrounding the potential approval of a spot Ethereum exchange-traded fund (ETF) by the US Securities and Exchange Commission (SEC) in May.

Standard Chartered, a British multinational bank, predicted a favorable outcome for a spot ETH ETF approval. Key figures at crypto asset management firms, such as Bitwise, Grayscale, and Galaxy Digital, estimated a 50% likelihood of approval for these pending spot Ethereum ETF applications.

Meanwhile, applicants like VanEck, Ark Invest, and 21Shares are adjusting their applications to align with the SEC’s criteria for approving a Bitcoin ETF.

Furthermore, market sentiment has been buoyed by the upcoming Dencun upgrade. This upgrade will introduce features like proto-danksharding and fee reductions. In addition, the upgrade will help enhance Ethereum’s network performance, reduce transaction costs, and improve ecosystem interoperability.

The broader market sees red.

The broader crypto market experienced a decline during the reporting period, with the global crypto market capitalization dropping by 0.32% to $1.96 trillion.

Bitcoin surged to a new yearly peak just below $53,000 but swiftly dropped to $51,268 as of press time, according to CyptoRanking’s data.

Large-cap digital assets like Solana, Avalanche, Cardano, and Ripple’s XRP saw losses exceeding 3%. However, Binance-backed BNB coin and Tron’s TRX token bucked the trend, registering gains of under 3%.

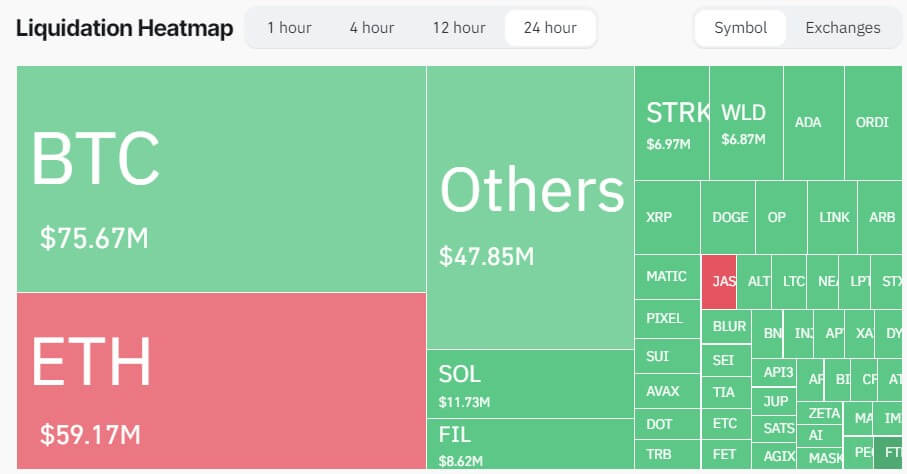

These price movements triggered significant liquidations, totaling over $291 million from more than 92,000 traders, per Coinglass data.

Bitcoin led the liquidation figures with a total loss of $75 million. Long Bitcoin traders accounted for $42 million in losses, while short traders lost $28.46 million. Ethereum followed closely, contributing $59.1 million to the overall liquidation, with short traders bearing the brunt of the losses.