Is Bitcoin’s pre-halving retrace over? 52K BTC accumulated on Sunday alone

Bitcoin’s pre-halving retrace may already be over following one of the largest accumulation days in years, which saw Bitcoin reclaiming the $71,000 price level.

On March 25, blockchain analytics firm Santiment reported that Bitcoin just “caught traders off guard” with a rebound as “key stakeholders” had a huge accumulation day over the weekend.

Wallets, which it terms ‘sharks’ and ‘whales’ holding between 10 and 10,000 coins, accumulated 51,959 BTC on March 24 worth around $3.4 billion at the time, the firm revealed. It added that this equates to 0.263% of the entire currently available supply being accumulated in one day.

As the Bitcoin halving approaches, three weeks away on or around April 19, “it would be unsurprising to see these wallets continue to grow, resulting in a positive impact on crypto-wide market caps,” it noted.

Crypto analysts were concerned about a more sizeable pre-halving retrace, assuming that history would rhyme with previous market cycles. However, BTC only fell around 17% from its March 14 all-time high of $73,738, dipping to $61,494 on March 20, according to CoinGecko.

Technical analyst ‘Rekt Capital’ said that if this ends up being the end of the pre-halving retrace, Bitcoin will have almost equaled the 2020 pre-halving retrace.

“Bitcoin pulled back -18% in this cycle whereas BTC retraced just over -19% in 2020,” he noted.

The analyst had previously predicted that this pre-halving retrace “would more likely be on the shallower side than on the deeper side” and could also be much shorter than has otherwise been the case historically.

Related: Trading Bitcoin’s halving: 3 traders share their thoughts

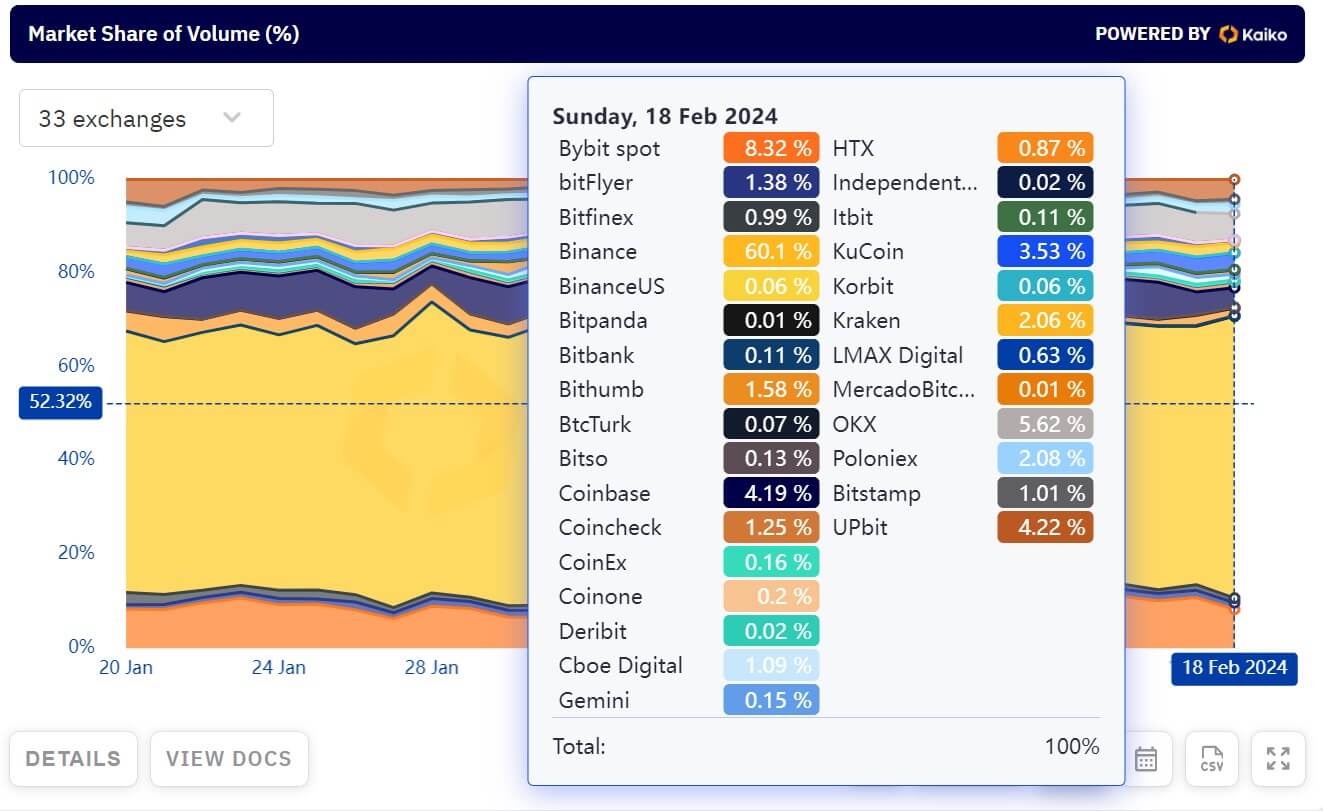

Reporting on market volatility and last week’s dip on March 25, crypto research firm Kaiko, revealed that after an analysis of buy and sell orders, “selling intensified following the U.S. market close.”

It concluded that “liquidity in the cryptocurrency market is not only fragmented across exchanges but also across trading pairs.”

BTC was trading up 5.2% on the day at $70,252 at the time of writing after hitting an intraday high of $71,000 in late trading on March 25.

Magazine: ‘Am I sorry? No’ — 3AC founder. $6B BTC laundered for fast food worker: Asia Express