Independent financial advisors start disclosing Bitcoin exposure via ETFs

Signal Advisors, a Michigan-based startup serving independent financial advisors, disclosed ownership of 20,571 BlackRock iShares Bitcoin Trust (IBIT) shares.

Wedmont Private Capital, a Philadephia-based Registered Investment Advisor (RIA), disclosed ownership of 3,471 shares of Fidelity Bitcoin ETF (FBTC).

Spot Bitcoin ETF shares comprise a small amount of each firm’s investments. Wedmont has over $1.3 billion in assets under management (AUM), while Signal’s AUM stands at roughly $403 million.

The companies’ other holdings primarily consist of traditional exchange-traded funds (ETFs), stock investments, and other assets.

Advisors begin stacking Bitcoin

Investments from Signal and Wedmont provide evidence that financial advisors and related firms are beginning to invest in spot Bitcoin ETFs. The two firms are among the earliest to add Bitcoin to their portfolios based on known disclosures.

Another firm, Burkett Financial Services, disclosed on April 1 that it owned shares of both IBIT and ProShares’ Bitcoin Strategy ETF (BITO).

Industry experts believe this is only the beginning of similar disclosures in the coming days. Independent financial commentator Macroscape predicted larger disclosures as other firms submit similar filings in the “coming weeks.”

In March, Cetera Financial Group launched a new initiative to help financial advisors incorporate spot Bitcoin ETFs into investment strategies to address the rising demand for Bitcoin investment options. Cetera is a significant force in the US wealth management industry with a network of over 12,000 financial advisors and approximately $475 billion in AUM.

Inflows on the rise

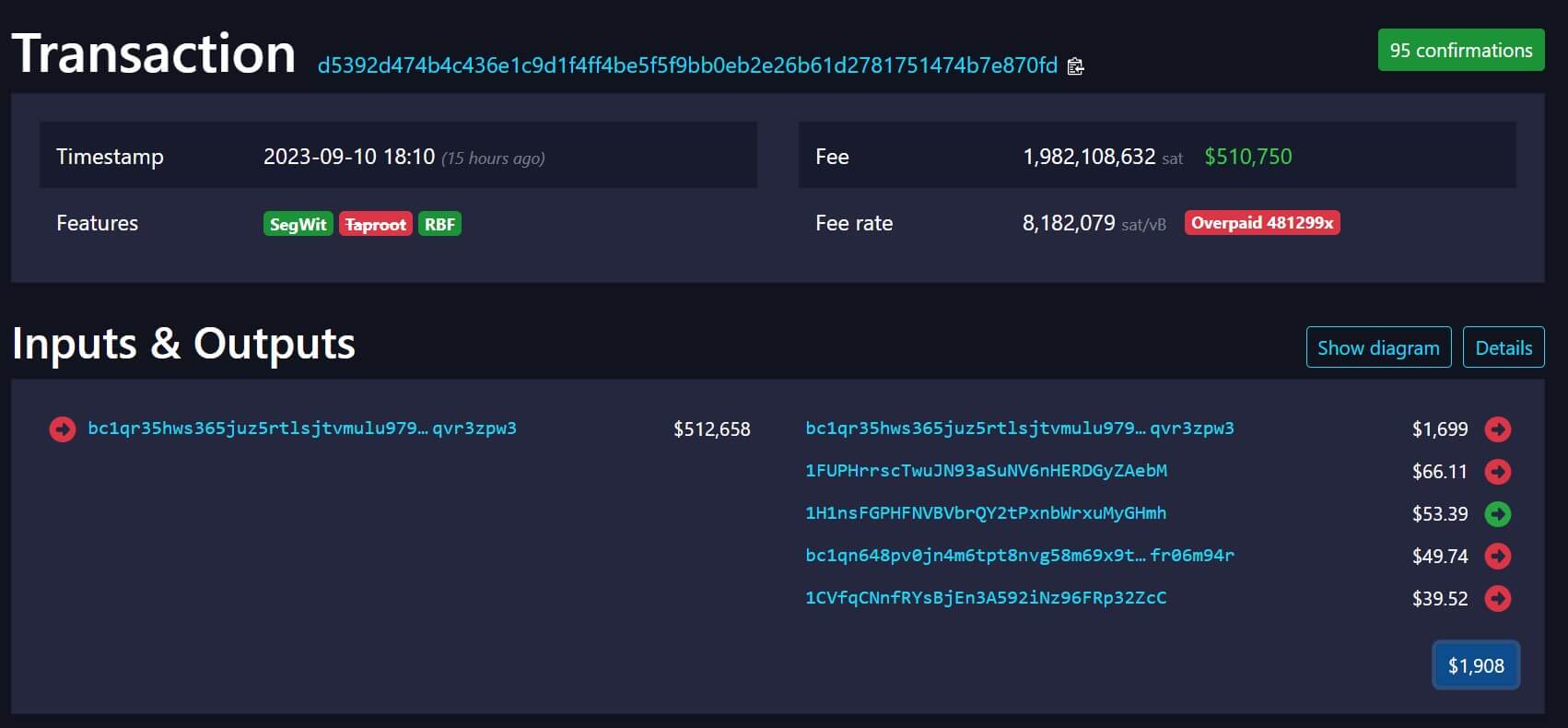

Inflows also demonstrate strong performance from spot Bitcoin ETFs alongside any recent demand from private companies. Data from Farside on April 9 shows that spot Bitcoin ETFs have collectively recorded $12.3 billion in total inflows — including GBTC outflows — as of April 10.

The two largest funds have accumulated billions in the first three months of their launch, with IBIT currently standing at $14.7 billion in total inflows, while Fidelity FBTC has surpassed $7.9 billion.

The two funds have set multiple records in the ETF market and have not seen a single day of outflows for over 60 trading days.

Short-term data from CoinShares on April 8 indicated spot Bitcoin ETFs saw inflows experienced high inflows of $646 million during the first week of April despite a red start to the month.