cyptouser1 years ago378

...

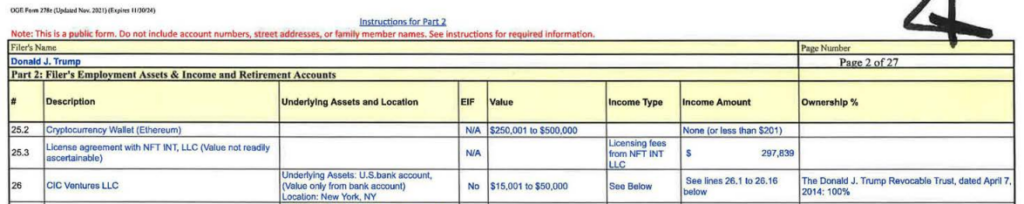

Is Trump’s $500k crypto wallet just his own NFT trading card collection?

cyptouser1 years ago418

Former U.S. President Donald Trump, well-known for his skepticism towards cryptocurrencies, has been...

Coinbase CEO admits to broken UX, promises rapid improvements following customer feedback

cyptouser1 years ago373

Coinbase CEO Brian Armstrong said the exchange would improve the user experience...

SEC partisan divide could alter Bitcoin ETF approval odds, former SEC attorney predicted

cyptouser1 years ago421

According to former SEC attorney John Reed Stark the current SEC, under the chairmanship o...

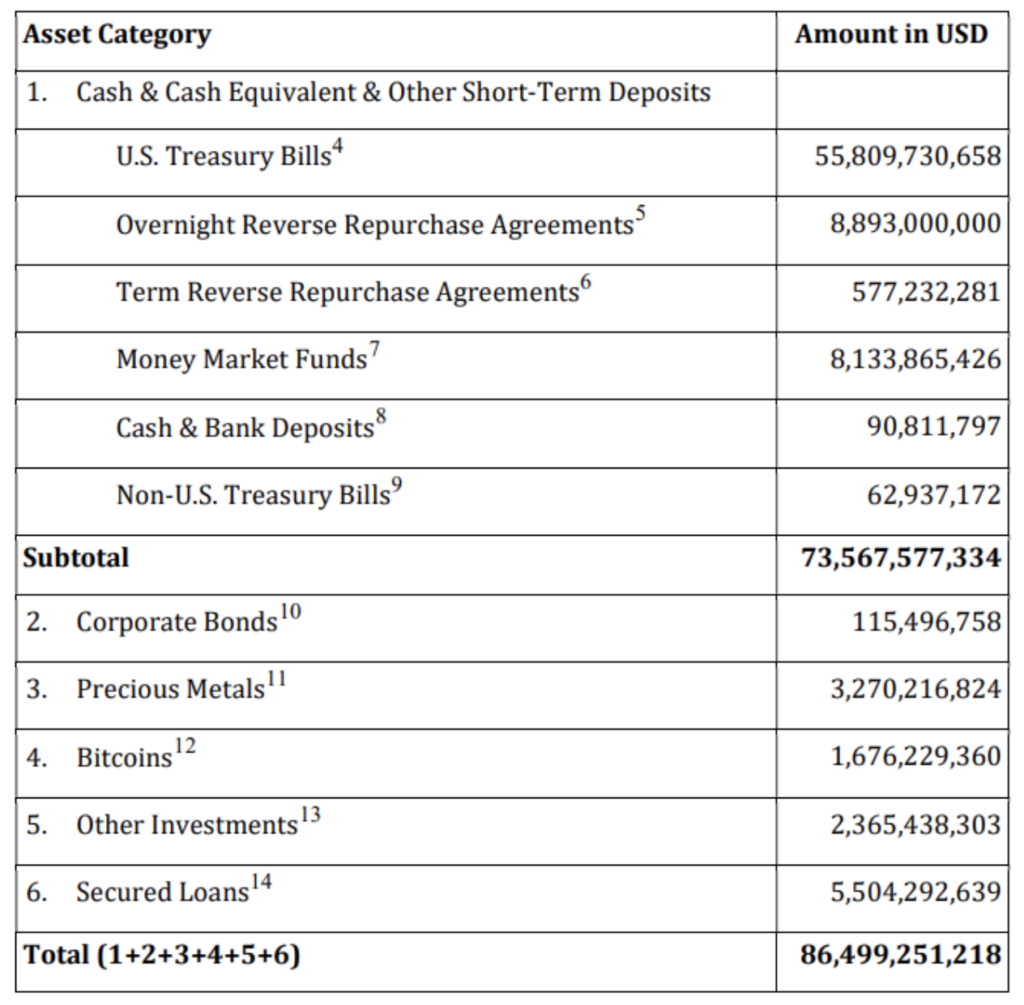

Is Tether’s profitability a risky bet on treasury profits?

cyptouser1 years ago423

Tether, the issuer of the world’s largest stablecoin, USDT, is breaking all records in 2023. In its&...

PayPal aiming for DeFi push after stablecoin launch – SVP Blockchain, crypto

cyptouser1 years ago295

PayPal intends to continue its push into the crypto industry by integrating its newly launched&...

Law expert says the amicus brief filed by 6 law scholars ‘absolutely shreds’ the SEC’s theory

cyptouser1 years ago386

Crypto lawyer James Murphy called the amicus brief filed by 6 law scholars to support Coinbase ...

Ethereum MEV incentives limit decentralization new report shows

cyptouser1 years ago320

On blockchain networks like Ethereum, decentralized validation underpins the entire ecosystem....

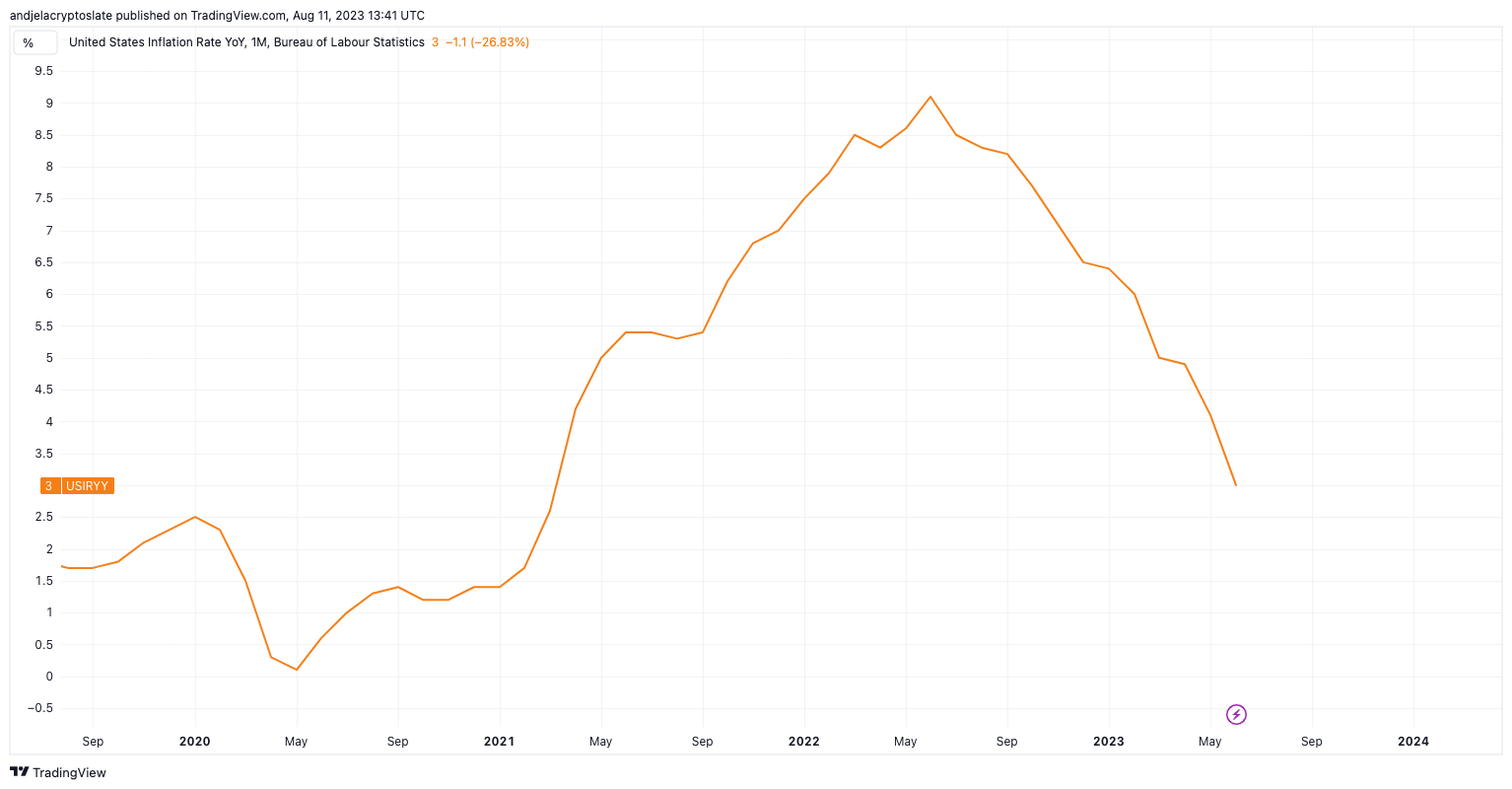

Inflation in the U.S. has shown signs of slowing down, but that doesn’t mean the global market is s

cyptouser1 years ago340

Inflation in the U.S. has shown signs of slowing down, but that doesn’t mean the global market is sa...

NFT tool Sketch launched by Access Protocol pumps ACS amid sector downturn

cyptouser1 years ago325

Solana-based (SOL) web3 platform Access Protocol (ACS) has launched Sketch, an NFT discovery, and no...