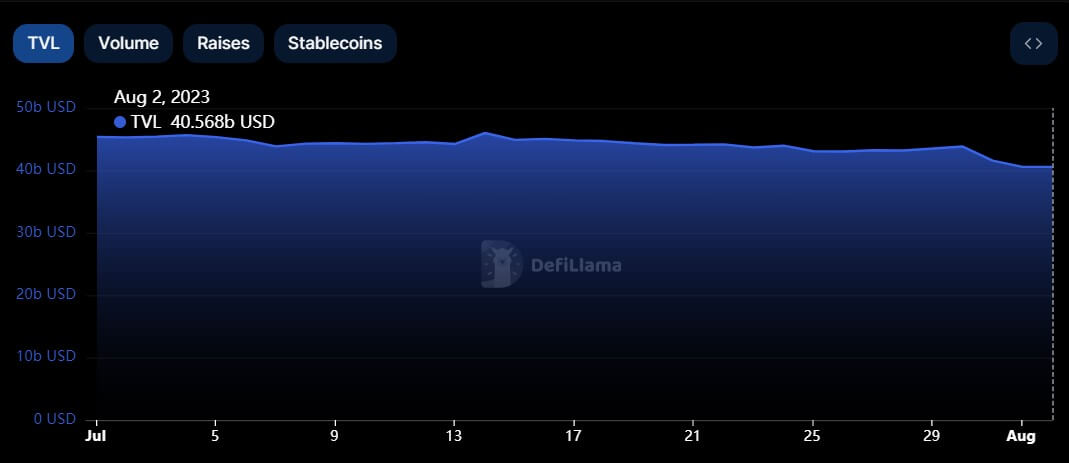

Total value locked across DeFi protocols down more than $3B since Curve Finance attack

In the last three days, the DeFi sector has seen an 8% decline in the total value of locked assets (TVL), falling to $40.31 billion, as per DeFiLlama data.

As of July 30, DeFi projects TVL stood at $43.81 billion but witnessed a sharp decline after malicious players attacked several Curve (CRV) pools on July 31. Following the attack, crypto investors began withdrawing their assets, totaling over $3 billion, across different protocols as contagion fears emerged.

Curve and Convex dominate losses

According to DeFiLlama data, two DeFi protocols—Curve Finance and Convex Finance—account for about two-thirds of the drop, with their TVLs falling by more than $1 billion each during the last three days.

Curve and Convex, two of the most prominent DeFi protocols in the crypto market, have a significant relationship, given that Convex enables users to tap into liquidity and generate earnings from Curve’s stablecoin pools.

At their peak, the protocols had a combined TVL of more than $40 billion as they attracted millions of users to the sector.

Meanwhile, the decline was not restricted to these two protocols as others, including UniSwap (UNI), Aave (AAVE), and others, also saw losses following the incident. However, DeFiLlama data shows these platforms have posted mild recoveries from the fall during the last 24 hours.

Lenders are pulling liquidity

The TVL decline can also be attributed to lenders pulling their liquidity from DeFi platforms as the uncertainty in the industry continues to spread.

As an immediate response to “mitigate contagion risks,” Auxo DAO, a decentralized yield-farming fund, announced it had “promptly removed” all its position on Curve and Convex.

Besides that, Curve Finance founder Michael Egorov has about $100 million in loans on different DeFi platforms backed by 427.5 million CRV (47% of total CRV supply), prompting fears of bad debt should CRV’s price drop below a certain threshold.

According to crypto research company Delphi Digital, the size of Egorov’s position could potentially trigger knock-on effects across a major part of the DeFi ecosystem.

DeFi platforms like Aave have already experienced significant withdrawals because of these fears. The platform is seeing a surge in borrowing fees and interest rates, intensifying the liquidation risk for users with outstanding loans.

Meanwhile, Egorov has sold CRV to investors and institutions via OTC deals to pay off the debt and prevent liquidation.