Coinbase CEO claims SEC said ‘every asset other than Bitcoin is a security’

The US Securities and Exchange Commission (SEC) reportedly asked Coinbase to stop trading in all cryptocurrencies besides Bitcoin.

In an interview with the Financial Times, Brian Armstrong, Coinbase CEO, revealed the US Securities and Exchange Commission (SEC) asked Coinbase to halt trading in all cryptocurrencies except Bitcoin before launching its legal attack against the exchange.

Last month, the SEC initiated legal action against Coinbase for failing to register as a broker. The regulator identified 13 cryptocurrencies on Coinbase’s platform as securities, arguing that by offering such tokens, Coinbase has come within the SEC’s regulatory ambit.

The SEC’s move to have Coinbase delist more than 200 tokens it offers, save for Bitcoin, may suggest a broader regulatory ambition under SEC Chair Gary Gensler. Armstrong told the FT,

“[The SEC] came back to us, and they said… we believe every asset other than Bitcoin is a security… And they said, we’re not going to explain it to you, you need to delist every asset other than Bitcoin.”

This assertion by the SEC, if agreed upon by Coinbase, could have seen a majority of American crypto businesses operating outside legal parameters unless they registered with the commission.

In response to the SEC’s request, Armstrong stated:

“We really didn’t have a choice at that point, delisting every asset other than Bitcoin, which by the way is not what the law says, would have essentially meant the end of the crypto industry in the US.”

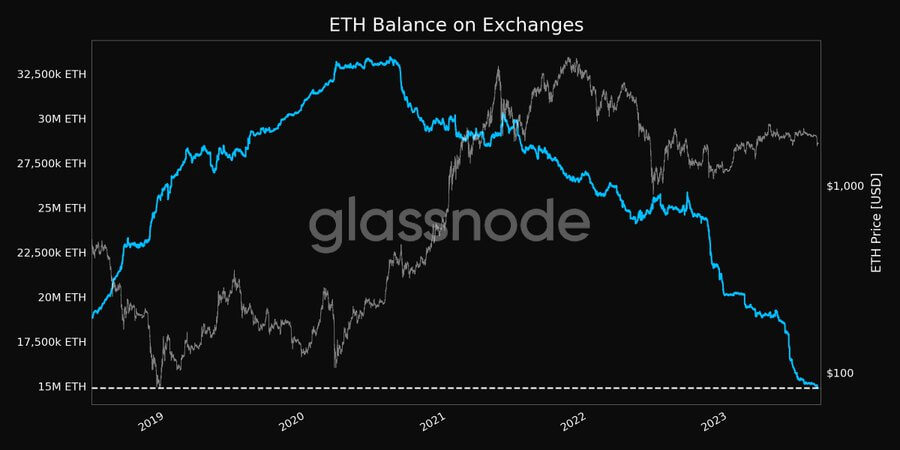

Gensler has previously proposed that most cryptocurrencies, with Bitcoin being the exception, are securities. Yet, Ethereum, the second-largest cryptocurrency pivotal to many industry projects, was conspicuously absent from the SEC’s case against Coinbase. It also did not appear in the SEC’s list of 12 “crypto asset securities” in the lawsuit against Binance.

According to the FT, while the SEC denied making formal requests for companies to delist crypto assets, the agency did acknowledge that its staff might share views on what conduct could raise questions under securities laws during an investigation.