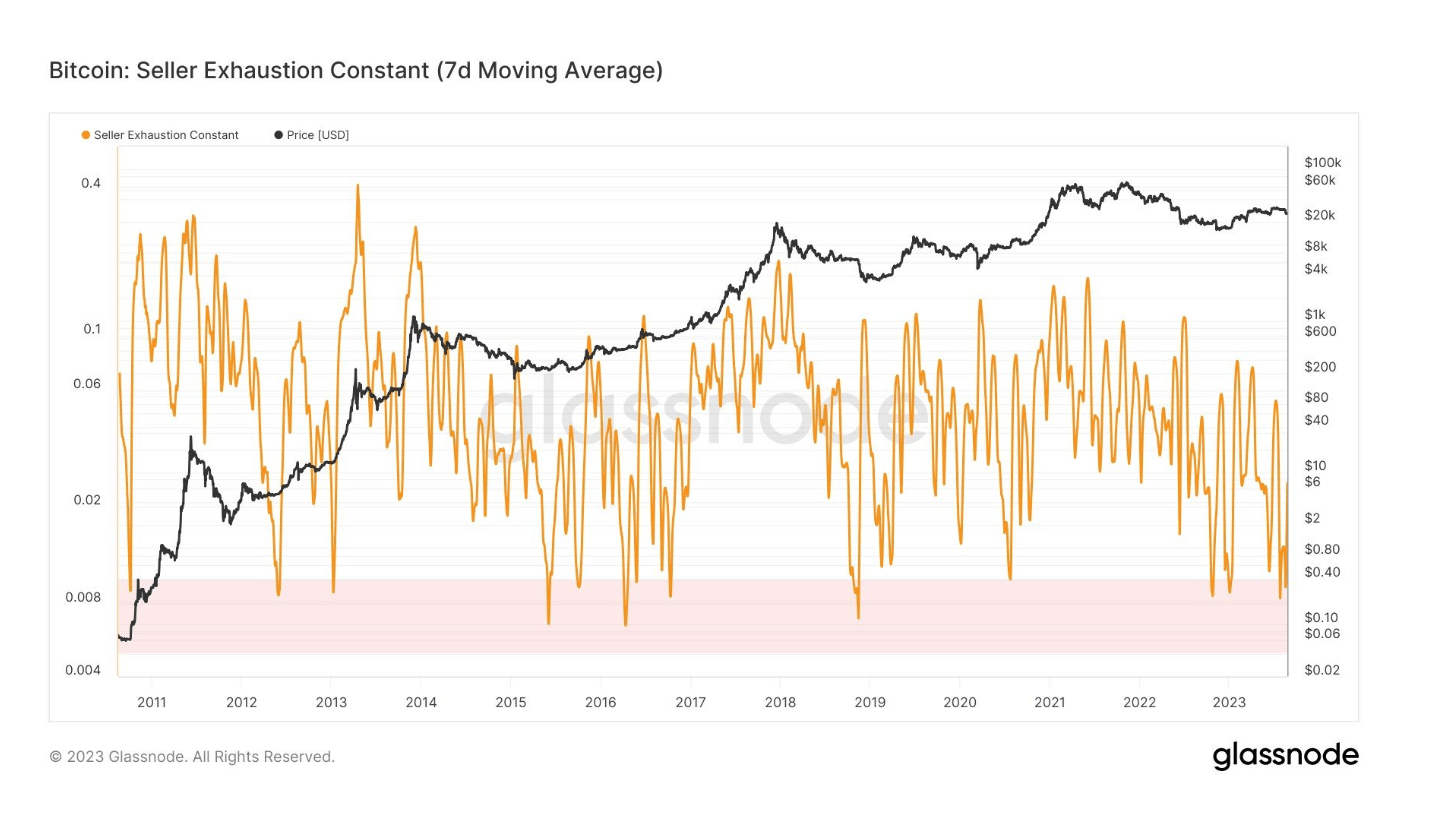

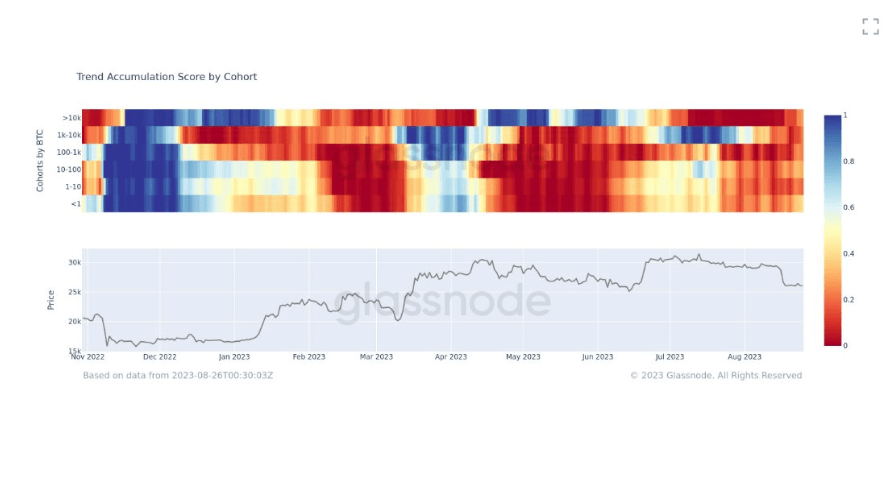

Bitcoin market poised as heightened seller exhaustion indicates low-risk bottom

The Bitcoin market in 2023 displays an interesting revelation: a marked escalation in seller exhaustion.

To put it in perspective, this rare occurrence has only occurred roughly 15 times in Bitcoin’s history, with an unusual concentration of four incidences in 2023 alone.

The metric, defined by the product of the Percentage Supply in Profit and 30-day price volatility, is an effective barometer for detecting periods of low-risk bottoms.

It acts as a canary in the coal mine, signaling when two contingent factors co-align: low volatility and high losses.

These are periods characterized by languid price fluctuations and a high proportion of sellers running at a loss.

Such events usually present a paradoxical situation where sellers are weary, and the market is seemingly at a low-risk bottom. The heightened frequency in 2023 of this historically rare metric provides a unique insight into the current dynamics of the Bitcoin market.